- USD: The dollar was on the defensive for much of Tuesday. Data today is of modest interest in the form of retail sales. Remember that tax hikes impacted the majority of Americans in January, so there is a particular focus on the retail sector and just how well it holds up. The market looks for a 0.5% gain on headlines sales.

- NZD: The central bank (RBNZ) decides on rates at 20:00 GMT. There is little expectation of a change in rates from the current 2.50. The kiwi has underperformed the Aussie of late, moving to a 6 week high at 1.2535 on AUDNZD. The current drought has been a factor and may cause a growth re-assessment from the RBNZ, but looking through this, bias is likely to remain for higher rates, but not in the near future.

Idea of the Day

The price action on sterling yesterday was very interesting and brings us to question just how much bad news a currency is able to take. Against the dollar and euro, sterling managed to recover all the losses by the end of the session. On the weekly charts, sterling is now at the most stretched levels since late 2008 in terms of the relative strength index (RSI).

This creates greater risk of a recovery in the pound as short positions are covered, but it’s likely to be more of a breather than a more sustained turn-around. There remains major uncertainty around policy, especially monetary policy given talk of a change in regime, possibly to be announced as early as next week (budget speech Wednesday).

Latest FX News

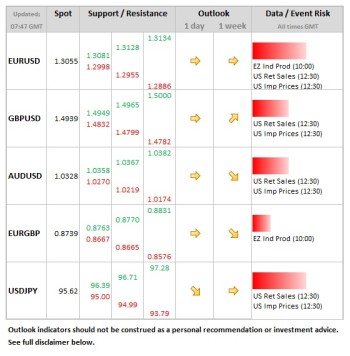

- EUR: The single currency is still hanging tight to the 1.30 area vs. the dollar, the next upside resistance seen at 1.3074 (Fibonacci 38.2%). Support being provided by good standing of peripheral bond markets, notably Spain and Italy.

- JPY: It was not a total surprise that the opposition said they would vote against the appointment of Iwata as one of the BoJ deputy governors. He’s seen as a strong advocate of further easing measures, so for now this has tempered fresh yen weakness.

- GBP: New lows on cable Tuesday after the industrial production numbers, but by the end of the day all of the post-data losses had been recovered, helped by the generally softer dollar tone. The currency is appearing oversold on weekly charts (14 week RSI), by the most since 2008.

- AUD: The Aussie held up well overnight above the 1.03 area, despite data showing home lending falling 1.5% in January, with the prior month revised lower to -2.1%. More: Forex Analysis: AUD/USD Continues Rise from Support within Trading Range