Editor’s note: We hereby bring the 2014 foreign exchange outlook written by FxPro Head of Research Simon Smith.

Executive Summary

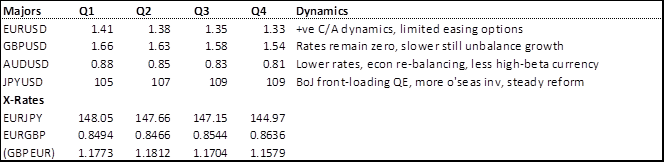

- The post-crisis FX environment will continue to be characterised by greater volatility and shorter trends.

- We see conditional dollar strength, which means that we are not heading for a secular dollar bull market as the Fed starts tapering.

- The euro will continue to surprise to the upside in the early part of the year, supported by current account dynamics, declining liquidity and low inflation, putting a break above 1.40 on EURUSD in sight.

- Sterling should also be buoyant early on, but the dynamics of the recovery, based on negative real wage growth and falling savings, are not yet conducive towards a sustained recovery.

- The yen will continue to weaken, but to nothing like the degree that was seen in the early part of 2013.

- The Aussie will suffer, with lower rates likely from the RBA and a re-balancing of the economy weighing on the currency.

The Majors in 2014

Contents

- Post-crisis FX market dynamics

- Dollar – Subtly Stronger

- The Euro – Defying Expectations

- Sterling – Good and Bad

- Yen – Tempered Depreciation

- Aussie – Losing the Fight

- Gold – Deeper and Down

| Post-crisis FX market dynamics | |

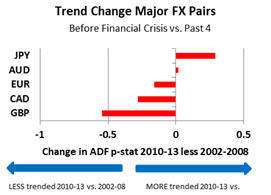

Currencies have become less trended in recent years

Overall FX volatility has been greater in the post-crisis period

Whilst trends have been shorter

Changes in central bank balance sheets matter less for FX

Firmer dollar dynamics likely in the second half of 2014

|

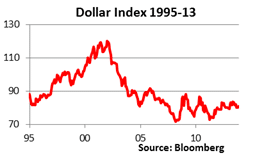

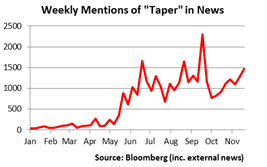

It’s worth putting into context the environment in which FX finds itself at the end of 2013. If there is one rule that works for FX, it is that no rule lasts forever (if that can be a rule!). FX is simply money, so the rate of return on money and hence central bank expectations remain integral. You only have to look at how tapering has entered the mainstream market lexicon to appreciate that; not only for FX but for pretty much every other market besides.But within this, there has been a big shift that still prevails today. In the period 2002-2008 H1, trend and momentum dominated many FX pairs. For example, let’s take the dollar index in the first two years of that period. Seventy-five percent of the months saw the dollar depreciate. The dollar was up only one year in the period 2002 to 2008 H1. In other words, it was a pretty strong bear market for the dollar. Consequently, for others it was a secular bull market, most notably for the Aussie, but also for the kiwi and euro.

Leaving aside the period in H2 2008 and 2009, we can contrast the pre-crisis period with the past four years. To do this for the majors, I looked at the change in the p-value for the ADF (Augmented Dickey-Fuller), which tests for the stationary (non-trended) or otherwise (upward or downward trend) over the period. Don’t worry about the numbers, just look at the change between the two periods, because this gives a measure of the degree to which the currency has moved from seeing a strong to weaker trend.

So the chart shows that this change is most stark for sterling. Having moved from 1.40 to above 2.10 in 2002-2007, it has held within a 1.42 to 1.68 range in the previous four years. In contrast, the sharp depreciation of the yen from late 2012 to mid-2013 means that on this measure at least, (there are alternatives) the yen has become a more trended currency in the post-crisis period.

This has not made life easy for those looking for big and sustained trends in FX markets, which is more the preserve of macro hedge funds rather than our average client. Again, taking the dollar index as a general but instructive proxy, it has not broken out of the range carved out in the second half of 2008 and the first half of 2009. So it’s pretty hard to say whether we’ve been in a bullish or bearish dollar market and those calling for a break higher on the back of Fed tapering (and ECB easing) have been left sorely disappointed by the price action in the second half of this year.

Overall, volatility has also been greater in this post-crisis period compared to levels prevailing in the pre-crisis period. The CVIX (from DB), measuring a basket of implied volatility on currencies similar to the VIX for equities, has been on average 25% higher in 2010 -2013 vs. the pre-crisis period.

This has meant two things for the bigger macro players. Firstly, trends have been shorter, so as soon as conviction rises, the trend can often reverse. Secondly, volatility can often stop-out trend followers, because intra-trend corrections tend to be larger.

The final issue that should be considered at the outset is the impact of central banks and QE on currencies. In the early days, it was pretty simple. QE pushed currencies lower, initially and principally the dollar, through a combination of cheap money and plenty of under-valued assets, especially beyond dollars. That interplay has become a lot weaker. Indeed, since QE3 started, the dollar is higher and its predecessor (operation ‘twist’) also prevailed over a strong currency.

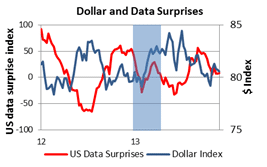

I started noting this changing trend in the early part of 2013 (see “From RORO to MORO“). Changes in central bank balance sheets (as a proxy for QE) started to matter less for currencies, the magnitude of data ‘surprises’ (the degree to which data was above or below expectations) mattered more. This largely continued for most of the year, especially when Fed tapering speculation built from May to early September.

The question is whether we are going to break out of this post-crisis dynamic in 2014. In reality, my suspicion is that we will not. We saw 2013 as the year of divergence, which probably applied to the first half, but has been largely frustrated in the second half, principally those looking for a sustained move higher in the dollar. A sense of dollar frustration will still be a feature, even when tapering has started. The Fed has assured markets that tapering does not mean tightening, limiting the upward drift of market rates. The firmer dollar dynamics are likely more in the second half, once tapering is more complete. The Aussie will be the weakest on the majors and the euro will continue to surprise to the upside, more so in the early part of the year. |

The Majors

| Dollar – Subtly Stronger

The Fed has successfully split the difference between tapering and tightening

Despite recent progress the political and budget backdrop remains a risk

Other currencies will weaken but not to the extent seen in 2014

|

First in, first out underlines the expectation that the dollar will dominate in 2014 and was the basis for dollar bullish views in H2 2013. The US was the first into the global financial crisis, the first to cut rates, enter QE and has seen its economy move over 5% above the pre-crisis peak in output.The basis remains sound, but we don’t expect this to lead to a dominance of the dollar in 2014 for three primary reasons. Firstly, the FOMC has been successful in splitting the difference between tapering and tightening, so that markets are able to separate the difference between them. This will allow the Fed to start tapering earlier than previously expected, possibly in December, latest March 2014, with the Fed opting for smaller incremental moves. Markets will equate this with a move higher in the Fed Funds target rate, but not to the extent that was seen in September 2013. Tapering will be dollar positive, but not to the same extent as would have been the case in September this year.

Secondly, the fiscal and political backdrop will act as a restraint on sustained dollar strength. The impact of sequestration is biting and the political process in the US remains fractured, as the debt ceiling and government shutdown illustrated. At the time of the previous shutdown in August 2011, we wrote how the dollar’s reserve currency status acted more as a curse rather than a blessing. There were signs in September/October of this year that markets were perhaps less tolerant of a currency at the mercy of the fractious political process. More positive signs are emerging at the end of 2013 on the budget, but it’s limited and still fractious.

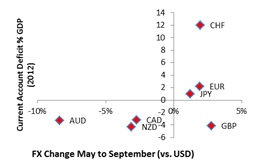

Finally, you can only value a currency in relation to others. Whilst we do see the dollar gaining ground against the yen and Aussie, it’s not going to be to the extent that we saw in the early part of 2013. Policy inspired depreciations for both have largely run their course. Sterling will put up a decent performance on the back of a stronger economy, but this may well unravel in the second half of the year. The euro will still show an underlying resilience that could well catch the market off guard once again.

So, conditional dollar strength is our preferred scenario, with post-crisis FX dynamics still making for shorter trends, greater volatility and an absence of the great dollar bull phase that has so far eluded the greenback. Our forecasts suggest around a 4% depreciation through 2014. Compare this to the 8% average absolute change in the dollar in the pre-crisis era of 1985-2008 (DXY dollar index). |

| The Euro – Defying Expectations

Outright QE from the ECB remains intellectually appealing but operationally questionable

Lower inflation in the periphery is an imperfect cure

The euro should continue to perform well in the early part of 2014

|

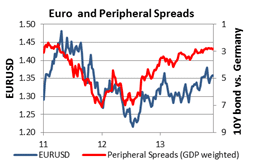

Leaving aside events in Cyprus earlier in the year, this was the first year since the Greek bailout in 2010 that the single currency was not jumping from crisis to crisis. In the background, Draghi’s infamous pledge to do “whatever it takes” in the summer of 2012 (backed up with the OMT programme) provided a strong structural support to the euro. It meant that the market could move on from obsessing about Italian and Spanish bond yields.The extent to which structural problems are being solved or just being pushed in into the future (let’s not mention cans) remains valid. I don’t see this being resolved in 2014. Instead the impact of anaemic growth, low inflation (deflation in some of the periphery) will be shielded by the presence of the OMT, together with further policy measures from the ECB (more liquidity, negative deposit rate). Outright QE remains intellectually appealing, but operationally questionable and politically unacceptable, especially in Germany.

The often asked question is whether the worst is over? Probably not is the answer. Most likely 2015 will be more painful than 2014 as the impact of higher bond yields globally impinges on the funding costs of both peripheral and some core markets. The politics is complicated, but the economics is a lot easier. Debt crisis are only really solved via inflation, currency devaluation or default and most likely a combination thereof. Low growth and fiscal policies are limiting inflation (and threatening deflation in some cases), the second is not an option and default remains politically unacceptable, bar the restructuring seen in Greece.

But internal devaluation, seeing lower inflation in the periphery vs. the core is an imperfect cure for two reasons. Firstly, it needs to be matched by labour costs, which has happened in Ireland, is happening Greece, but is absent in Italy (and also France). Secondly, it comes because of Germany’s intolerance of high inflation (for structural and historical reasons). |

Sterling – Good and Bad

Business investment has detracted from growth in recent years

Positive growth dynamics should continue to support sterling early in 2014

|

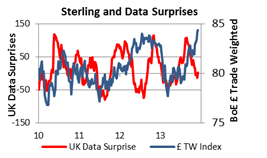

The story of sterling is familiar to all, namely one of continued disappointment on growth (lower) and inflation (higher) weighing on its shoulders. This started to turn in the twilight of Mervyn King’s tenure at the Bank of England, with growth for the year seen around 1.5% (expectation was for 0.8% back in May).The currency has naturally responded in kind, the strongest performer on the majors in H2. This has happened despite the Bank’s attempt at forward guidance, offering assurance to markets that rates will stay low so long as unemployment remains above 7% (with lots of caveats).

But there is good growth and bad growth. The investment and net export-led economy that the Bank has so long wished for remains largely absent. Since 2010, residential investment has accounted for 20% of the cumulative growth in the economy. Business investment has detracted more than 1% from the cumulative 4% growth in the economy over this time.

Net trade (exports minus imports) has done better, contributing to 20% of the growth, but has deteriorated more recently and the stronger pound and shaky eurozone recovery don’t paint a particularly bright future.

All well and good, but when does the currency start to care? Up to now, it has been happy with the headlines. When we are talking more about risks, then it’s harder to predict the exact timing of how these are going to evolve. Certainly, near-term there is a sense that sterling has run away with itself, the disconnect between sterling and the data at the widest for over a year. An earlier move on tapering from the Fed may also support such a correction.

So for sterling it could well be a year of two (uneven) halves in 2014. Early on, positive growth dynamics could still provide some support for sterling. Furthermore, there is the issue of inflation. This is going to be more of an issue than for the eurozone, largely because of capacity destruction over previous years. The Bank won’t feel confident enough to increase rates, but real wage growth will remain negative. Recent growth has been reliant on the housing market and households running down savings. This can’t continue, but the lack of recovery in business investment has been the single biggest disappointment in the past 3 years. Low rates, a slower economy and continued inflation stickiness are why we see sterling lower through most of next year. |

| Yen – Tempered Depreciation

Bank of Japan is likely to up the pace of their QE program

Gradual diversification from cash could weaken the yen in 2014.

|

The second half of 2013 was largely one of frustration for yen bears. November 2012 to May of this year, the impression was that this was something big. Throw in Fed tapering speculation and an Upper House election success for Abe in July, then yen weakness was again the big call for the second half. It only really started to come together towards the end of November, which was too late for many large FX funds, once again frustrated than the yen was behaving badly.We cautioned against becoming bearish on the yen, both in April and June (see “Why markets misjudged Japan“). The timing was not perfect (more for April, just short-term), but the sentiments were broadly in line. The easy lifting with QE had passed, the structural reforms were a lot tougher and took longer and the inflation target was unlikely to be met in the time-frame desired.

Thus our rational for expecting yen weakness is not predicated on the fact that is has not happened for most of the past 6 months. It’s based on 3 main factors. Firstly, the expectation that the BoJ is likely to up the pace of their QE program in the early part of 2014. Secondly, the strong current account surplus is likely to continue to deteriorate, thus one of the mainstays of the stronger currency and Japan’s strong net creditor status globally is taken away. Thirdly, changes to savings legislation are designed to move investors away from cash towards shares and trusts and within this, also overseas. More than half of Japan’s personal financial assets are in cash and deposits, around 3.5 times that of the US. The impact from this is likely to be gradual, but nevertheless will be material given the large savings pool.

|

Aussie – Losing the Fight

The RBA is likely to ease again in 2014

Aussie likely to head to 0.80 towards the end of 2014

|

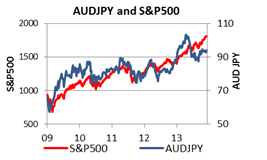

Since its peak mid-2011, the Aussie has hardly been a one way street and has also epitomised the more fractured natures of FX markets I discussed earlier. Yes, there were weakening trends Q2 2012 and Q2 2013, but both were followed by sustained corrections. This highlights that there remain continued positive forces underneath the Australian currency, which given the right opportunity, can and do shine through (principally carry, positive relative growth dynamics). But the Aussie is not trading like the high-beta commodity currency it once was. Indeed, this impact was noticeable in the middle of last year (“The shifting sands of FX“).There are two principal factors that will undermine the Aussie in 2014. Firstly, the gradual withdrawal of the single biggest contributor to GDP growth in recent years, namely mining investment. Secondly, there is the prospect of further rate cuts, with at least one further easing likely from the RBA in the early part of the year.

For its part, the RBA has not been backwards in coming forwards regarding its views of the currency which it sees as “uncomfortably high” according to the latest RBA statement. The RBA has also stated that a weaker currency would support a rebalancing of the economy (greater reliance on domestic demand).

Of course, what a central bank wants, a central bank doesn’t always get, especially when it comes to the currency. But in the case of the Aussie, there is a decent chance. The fact that it has partially already happened and that it has been trading far less like a high-beta currency for the past year will mean that the decline is not precipitous, but a move close to 0.80 on AUDUSD is entirely plausible by year end.

|

Gold – Deeper and Down

Further downward pressure likely on gold in 2014

|

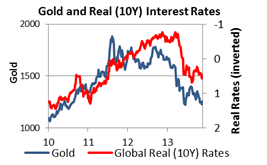

It’s worth touching briefly on the broad outlook for e gold, especially in the context of the likely tapering of bond purchases by the FOMC.On gold, I’ve been pretty bearish for most of the year (see “Far from over for gold“). Data from ETF holdings and elsewhere suggest that we saw a big shake-out in the middle of the year, which has seen investors throw in the towel on the “QE=inflation” trade. On one level, this should bring gold to a more realistic valuation, but the question is whether we are there yet.

One of the stronger valuations is vs. real interest rates. Using our measure of global real 10 year rates (GDP weighted 10 year bond yields less inflation), it’s difficult to see gold going against the fairly strong inverse relationship that has existed, with real rates representing the opportunity cost (what you can get above inflation) of holding gold, a non-yielding asset. With inflation remaining contained globally and the Fed tapering, then real rates are most like to rise, putting further downward pressure on gold. A move to $1.000/oz is likely in the first half of the year, with scope for some recovery in the second half of the year. |

| Simon SmithHead of Research FxPro

|

Disclaimer: This material is considered as a marketing communication and does not contain and should not be construed as containing investment advice or an investment recommendation, or, an offer of or solicitation for any transactions in financial instruments. Past performance does not guarantee or predict future performance. FxPro does not take into account your personal investment objectives or financial situation and makes no representation, and assumes no liability to the accuracy or completeness of the information provided, nor for any loss arising from any investment based on a recommendation, forecast or other information supplied from any employee of FxPro, third party, or otherwise. This material has not been prepared in accordance with legal requirements promoting the independence of investment research, and it is not subject to any prohibition on dealing ahead of the dissemination of investment research. All expressions of opinion are subject to change without notice. This communication must not be reproduced or further distributed without prior permission of FxPro.

Risk Warning: CFDs, which are leveraged products, incur a high level of risk and can result in the loss of all your invested capital. Therefore, CFDs may not be suitable for all investors. You should not risk more than you are prepared to lose. Before deciding to trade, please ensure you understand the risks involved and take into account your level of experience. Seek independent advice if necessary.