The Canadian dollar was already on the back foot due a series of blows (see 3 reasons for the C$ crash). And then, came the FOMC decision. Janet Yellen and her colleagues lowered unemployment projections and announced a third taper. This gave the US dollar a boost across the board and the already sensitive loonie was hit badly.

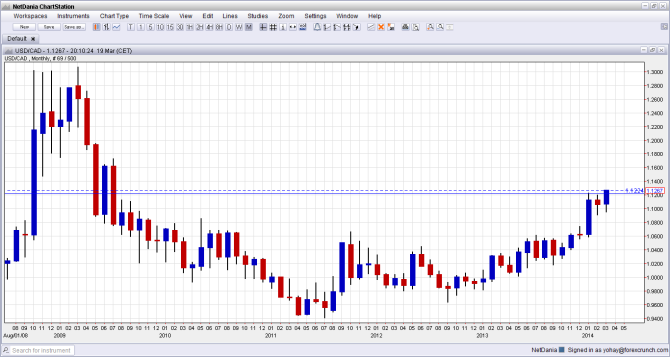

Here is the long term chart that reflects the surge of USD/CAD (fall of CAD):

1.1224 was the January 2014 high. In the immediate aftermath of the statement, we have seen the initial break, but the move was limited. As Yellen began talking, a second wave of US buying began and the breakout was confirmed.

The last time that Dollar/CAD saw these levels was in June 2009: 4 years and 9 months.

1.1270 is the new high at the time of writing. The next major level is only at 1.1473. For more, see the USDCAD forecast.