Technical Bias: Bearish

Key Takeaways

“¢ Euro continued to trade lower against the Japanese yen, as the 50-day simple moving average acted as a barrier.

“¢ More downside towards the 134.60 level is very likely in the near term.

“¢ EURJPY support seen at 134.60 and resistance ahead at 136.50.

The Euro managed to trade higher against the Japanese yen during this past week, but during this week it failed to break an important resistance level, which acted as a catalyst for sellers.

Technical Analysis

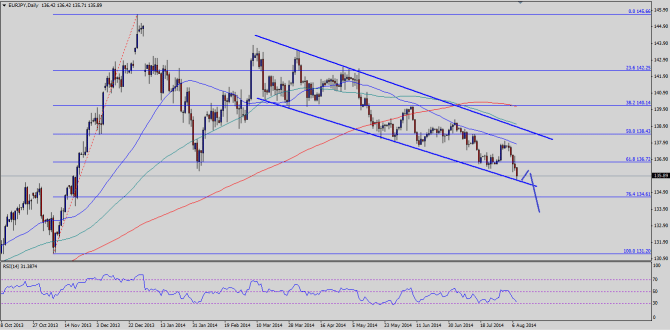

There is a monster sliding channel formed on the daily timeframe for the EURJPY pair, which has been acting as a support and resistance recently. Currently, the pair is trading around the channel support area. If the Euro sellers gain control and manage to break the 135.60 support level, then a move towards the 76.4% Fibonacci retracement level of the last move higher from the 131.20 low to 145.66 high is possible. It might even move down towards the last swing low of 131.00 where the pair might find buyers to hold the downside. There is divergence on the daily RSI, which suggest more losses are possible, but it is also heading towards the 30 level, which can act as a barrier for the Euro sellers. As it can be seen from the chart that the pair has bounced every time in the recent days when the daily RSI has reached the extreme levels, so there is a chance of a pullback in the near term.

If the pair manages to gain bids from the current or a bit lower levels, then initial resistance can be seen around the last swing high of 136.50 level. Any further upside acceleration might see sellers around the all-important 50-day SMA.

Overall, as long as the pair is trading below the 138.00 level a move towards the 134.00 support area cannot be denied.