Technical Bias: Bullish

Key Takeaways

“¢ Australian dollar continues to gain traction against the New Zealand dollar.

“¢ AUDNZD pair eye a break above the 1.1050 high to gain momentum.

“¢ AUDNZD support seen at 1.0965 and resistance ahead at 1.1050.

The Australian dollar outperformed the New Zealand dollar recently and looks set for a move above the previous high to challenge the 1.1100 resistance area.

Technical Analysis

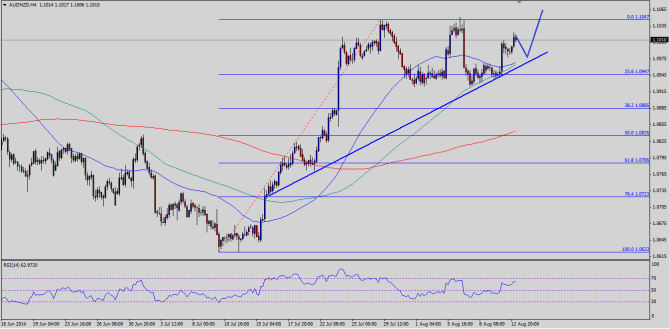

There is an important bullish trend line on the 4 hour chart for the AUDNZD pair, which managed to hold the downside in the pair on a number of occasions. The most important point to note is that the mentioned trend line is also coinciding with a critical confluence area of 50 and 100 simple moving averages on the 4 hour timeframe. So, if the pair falls a bit from the current levels, then it is likely to find support around the 1.0965 level. On the upside, initial resistance can be seen around the previous high of 1.050. A break above the mentioned level might call for a run towards the 1.1100 resistance area where sellers could appear again.

On the downside, initial support can be seen around the highlighted trend line. A break and close below the 100 SMA (4H) might ignite a short-term bearish pressure on the pair, which could take it towards the 200 SMA (4H).

Australia’s Westpac Consumer Sentiment Index

Earlier during the Asian session, the Australia’s Westpac Consumer Sentiment Index was released by the Westpac Banking Corporation. The index managed to climb higher from 1.9% to 3.8%. Moreover, the Wage Price Index was also released around the same time by the Australian Bureau of Statistics. The outcome was disappointing, as the Wage Price Index declined from 0.7% to 0.6%.

Overall, as long as the pair is trading above the 100 SMA (4H) more gains look feasible moving ahead.