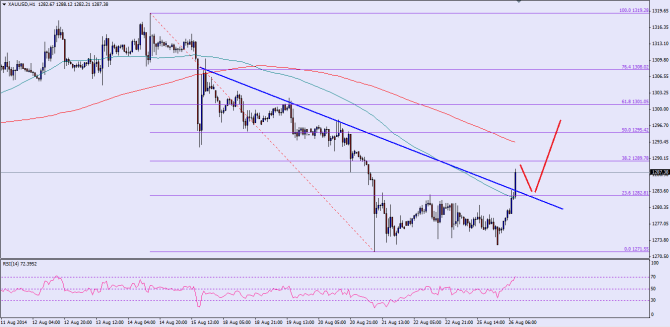

GOLD recently traded lower and breached an important support level of $1280. However, the $1270 level acted as a support and held the downside in the short term. The yellow metal prices consolidated for some time around the mentioned support area, and then managed to jump a bit higher to clear a short term resistance area. This break is likely to open the doors for further upside acceleration. There are a few important releases scheduled during the New York session including the CB consumer confidence, which might act as a catalyst for GOLD in the near term.

There was a major bearish trend line on the hourly chart for GOLD, which was breached recently. The yellow metal buyers also managed to clear the 23.6% fib retracement level of the last drop from the $1319 high to $1271 low, and now heading towards the 38.2% fib level. There is a chance that it might find sellers around the mentioned fib level. In that situation, it might drop back towards the broken trend line, which could act as a support moving ahead. The hourly RSI is also around the extreme levels, which means GOLD might correct a bit from the current or higher levels.

On the downside, initial support can be seen around the broken trend line at $1282, followed by the 100 hourly moving average. On the upside, initial resistance is around the 38.2% fib level. Any further upside acceleration might take GOLD towards the 50% fib level, which is just around the 200 hourly moving average.

Overall, buying dips might be considered if GOLD continues to trade above the $1280 support area in the short term.

————————————-

Posted By Simon Ji of IKOFX