EUR/USD managed to stabilize after the big falls and is trading in a wedge. Does this imply quieter times? What levels should be watched?

The team at SocGen discusses:

Here is their view, courtesy of eFXnews:

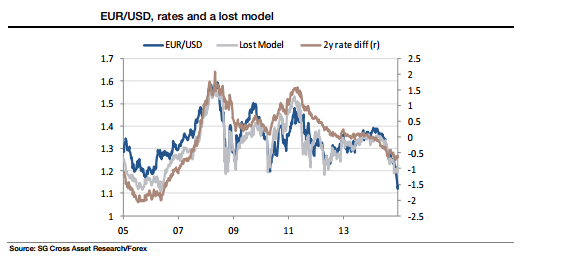

“…At the risk of using an out-of-date analytical tool to draw spurious conclusions, I would observe that the euro is about 6 ½ figures lower than the model suggests it ‘should’ be, and all other things being equal, that is the same as saying that the market is pricing EUR/USD off 2-year US interest rates that are about 60bp higher than they are now.

Or, to put it another way, the market is priced for 2-year Note yields a little above 1%, a level they would reach if the Fed raised rates to 0.5%. [The] FOMC left US short rate futures trading well inside their January range and still priced for a rate hike.

So maybe the way to think about EUR/USD is that we have priced in ECB QE and the latest rate cut, and at least one Fed rate hike with a high degree of confidence.

From here, we may well see a period of consolidation until something changes. A significant reversal back to 1.20 would require Fed rate hikes to be put on the back-burner, or a significant improvement in European data. Otherwise, EUR/USD 1.10-1.15 may hold for a bit and we can turn our attention elsewhere, unless the blow-out in Greek asset prices spills over to the rest of the Euro area.”

Kit Juckes, Societe Generale

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.