EUR/USD continues wobbling around 1.13 and is still looking for a direction.

If you are looking to short the pair, how should you position? The team at SEB dives in:

Here is their view, courtesy of eFXnews:

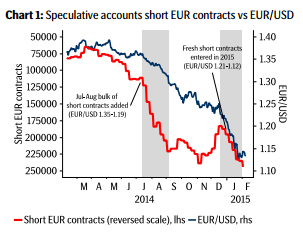

The bulk of the prevailing net speculative short EUR/USD was taken on-board back in Jul-Aug last year during a paced EUR/USD drop through 1.35-1.29 with a weighted average of 1.33, notes SEB Group.

“Over the past few weeks they had every reason to trim those during the late Jan-Feb correction higher, but as per Tue last week they instead kept adding to those shorts. Given presumed lofty profits in the books this correction higher has so far not been enough for those carrying shorts to reassess stance and thus not threatened bets on a further weakening of the euro,” SEB adds.

Main Scenario Still Points Lower:

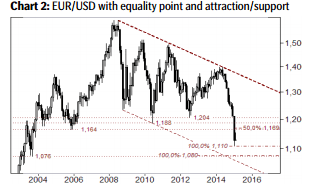

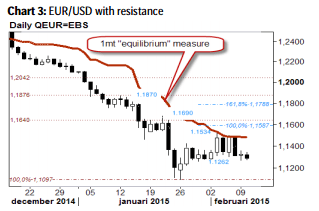

“Our main scenario is therefore that the past weeks slow climb is just part and parcel of a common three wave upside correction and as such a sustained drop back under 1.1260 would strongly hint of an already completed correction and bode for another attempt at a long-term “Equality point” of 1.11 – with prospects of an extended slide towards the next long-term interesting attraction/support below at 1.08-1.07,” SEB projects.

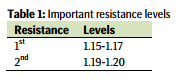

Resistance and Alternative Scenario:

“If speculative accounts watch the same chart as we do, there is hence limited reason to unwind performing shorts while holding below refs in the 1.1534 -1.1690 area – where we have the current reaction high, a short-term “Equality point”, a previously broken (2005) low and the Jan mid-body point acting as both attraction (for those putting opposite wagers for an extended correction higher) and resistance since this level ought to tempt sellers to respond to the correctional move higher,” SEB argues.

“Should a correction anyway not stop there, extension towards 1.1880-1.2040 (earlier violated 2010 & 2012 lows) and the current 55day moving average band would act as alternative attraction/resistance. The continued build-up of short positioning this year has occurred with EUR/USD between 1.21-1.12 with a weighted average of 1.1455. Therefore a break of the above stated resistance level 1.15-1.17 could lead to an alternative scenario with a larger upside reaction,” SEB projects.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.