EUR/USD seemed to have found a range between 1.05 and 1.10. But, can it maintain it?

The team at Barclays sees ambitious low targets for euro/dollar and explain the drivers.

Here is their view, courtesy of eFXnews:

How much lower can the EUR fall? “By our soundings, a lot”, answers Barclays in its quarterly note to clients today.

2-key drivers:

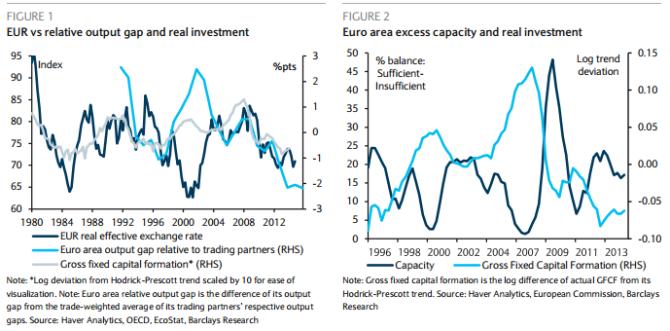

“The two key drivers of the multi-year downtrend in the EUR remain in force. In our view, remain the two that we identified last summer: 1) persistently low expected returns to capital in the euro area due to its relatively larger output gap and its structural impediments to growth; and 2) an Odyssian commitment by the ECB to a long period of low (or negative) interest rates. Both forces continue to augur for a much lower EUR, despite an encouraging pick-up in euro area economic indicators and a likely slowing in the pace of Fed tightening,” Barclays argues.

“In particular, as long as the ECB is committed to highly elastic provision of liquidity, the EURUSD will struggle to find its footing and risks come primarily from the US economy. In our view, a stabilization or turn in the EUR will require a sustained and convincing pickup in real investment or acceleration in core inflation that all into question the ECB’s commitments. Neither appears on offer anytime soon,” Barclays adds.

2-way risks:

“Two-way risks almost certainly have risen and we do not expect the torrid pace of EUR depreciation to be sustained. But the two drivers of EUR weakness appear strong, suggesting to us that the EUR still has much further to fall in its multi-year downtrend,” Barclays argues.

How much lower?

“After plunging 23% in 10 months, the question of how much further EURUSD can drop has moved to the fore…We now expect EURUSD to fall to parity by Q3 15 and to 0.95 by end Q1 16,” Barclays projects.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.