The Greek crisis, with all its ups and down is certainly moving markets, as we have seen with the recent spikes.

Nevertheless, the team at Goldman Sachs says we should follow the fundamentals and not the noise, and this implies a strong movement downwards.

Here is their view, courtesy of eFXnews:

Following yesterday’s FOMC meeting, Goldman Sachs US Economics team changed its central expectation on the timing of the first hike, which it now expects in December. From there, they expect the FOMC to raise rates by 100bp per annum, with the Fed Funds target range reaching 1.25-1.50% at the end of 2016 and 2.25-2.50% at the end of 2017 – roughly half way between the dots and the forwards.

“Strengthening economic data and rising asset prices will, in our view, lead the market to revise its pricing for the tightening cycle towards the FOMC median profile, i.e., re-building some risk premium,” GS argues.

As such, GS maintains its structural bearish view on EUR/USD arguing that despite its recent rise, fundamentals will ultimately take EUR/USD down in line with GS’ long-term forecasts.

“Our EUR/$ down view hangs on fundamentals. Here, our view is that the “growth crisis” in the Euro zone means that inflation will be slower to pick up than during a normal cycle, in line with projections from our European team that show HICP inflation reverting back to target only slowly. The reason for this is that structural reforms on the periphery (in labor and product markets) may hold down inflation for a given level of the output gap, which could reflect the Phillips curve shifting down.,” GS argues.

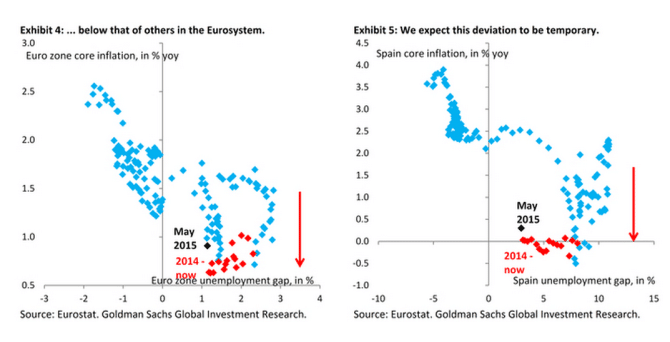

“Exhibit 4 shows some evidence for this, where the horizontal axis gives the unemployment gap – we use an eight year moving average to proxy for structural unemployment, which puts that around 10 percent currently, in line with our European team estimates – and core HICP inflation is on the vertical axis. Core inflation since early 2014 has shifted down for a given unemployment gap,” GS clarifies.

“This picture is most pronounced for Spain (Exhibit 5), where labor market reforms are arguably most advanced. There are obvious important caveats here, notably that the Euro zone is not a unified labor market. That said, this analysis points to low inflation in the Euro zone remaining a formidable challenge, which gives us confidence in our longer-term Euro down view,” GS adds.

GS maintains its EUR/USD forecasts at 0.95 in 12 months and 0.80 by end of 2017.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.