Talking Points

- British Pound has made a couple of attempts to clear $1.5700 against the US Dollar but failed.

- UK Retail Sales released by the National Statistics registered a rise of +0.1% in July 2015, which was lower compared with the forecast of a +0.4% increase.

- In terms of the yearly change, there was a rise of +4.2% – less than the market expected.

- UK CBI Distributive Trades Survey, which an indicator of short-term trends in the UK retail and wholesale distribution sector, increased from -10 to -1 in August 2015.

Key Highlights:

UK Retail Sales

UK CBI Distributive Trades Survey

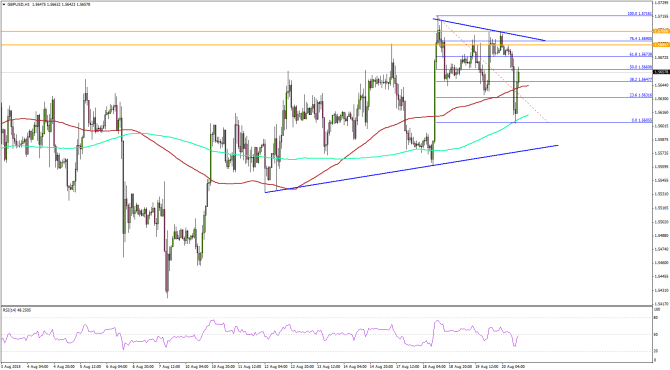

GBPUSD Technical Analysis

The GBPUSD pair has struggled on many occasions to clear the $1.5700 resistance area, and as a result we have seen a downside reaction. There was a minor bearish trend line formed on the hourly chart, which also prevented gains and pushed the pair lower.

The pair traded below the 100 hourly simple moving average (SMA), but found support around 200 SMA. It is currently correcting higher, and facing sellers around the 50% Fib retracement level of the last drop from the $1.5716 high to $1.5605.

It would be interesting to see whether the GBPUSD pair can make one more attempt to settle above the $1.5700 resistance area or not.

Fundamentals

Today, the UK saw a major economic release, as the Retail Sales, which measures the total receipts of retail stores was published by the National Statistics. The market was expecting it to increase by +0.4% in July 2015, compared to the preceding month. The result was disappointing, as there was a rise of only +0.1% in July 2015.

When we analyze the year-over-year change, then the quantity bought in the retail industry was also on the lower side. There was a rise of +4.2% in July 2015, compared with July 2014 which was lower compared with the forecast of +4.4%.

The UK Core Retail Sales came as a relief, as it was in line with the market forecast. It came in at +0.4% in July 2015, compared to the preceding month.

Overall, the Euro remains under the bearish pressure, which may continue in the near term.

“”””””””””””””””””””””””””””””””””””””””””””-

Article by Tom Daly, Academy of Financial Trading

“”””””””””””””””””””””””””””””””””””””””””””-