Commodity currencies have suffered badly, obviously due to the fall in commodity prices but also because of their particular issues.

The team at CIBC explains the situation and looks at what’s next:

Here is their view, courtesy of eFXnews:

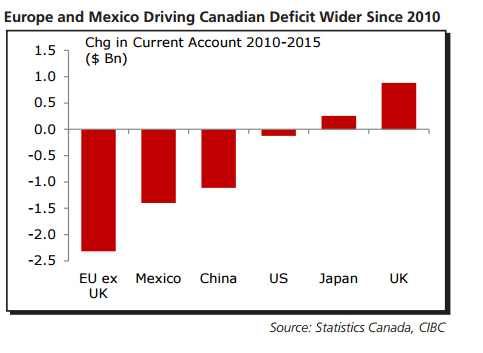

Not Just a Current Problem For C$. While it’s a “current” account by name, the deficit Canada is running with the rest of the world has implication for the C$ well into the future. The sharp decline in oil prices has obviously been the key factor driving the current account further into deficit recently. However, the deficit is also a lot wider now than it was coming out of the recession, when oil prices weren’t too far from current levels. Looking at moves since 2010, the change in the current account has been due to widening deficits with Europe and Mexico””not a smaller surplus with the US.

With the C$ little changed against either the euro or the peso recently, Canada’s current account deficit and the potential drag on the currency that it produces won’t be a quick-fix.

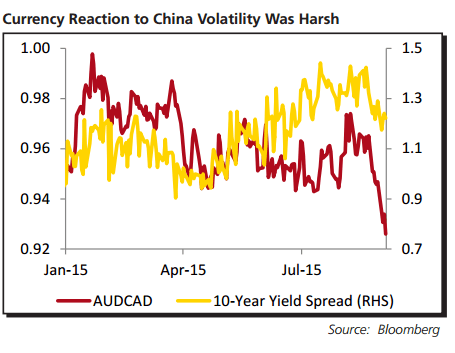

Aussie Dollar Taking It On The Chin From China. Negative sentiment regarding China has roiled financial markets recently, with the AUD particularly hard hit. Australia has strong trade ties to China and is a large exporter of commodities, so there were solid reasons for the weakness. But the question now is whether to expect some respite? With the RBA cautious about further rate cuts and no longer talking down the currency, there’s little pressure from policy makers. Therefore, positive yield spreads could attract some investors back to the currency.

Look for the AUD to hold its ground against the greenback in the run up to the Fed’s rate hike, while gaining ground against currencies like the C$ that have few prospects for higher rates in the near future.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.