Following the historic rate hike, which wasn’t so dovish (and enables a sell opportunity in EUR/USD in our opinion), the team at Goldman Sachs explains the move.

They also see a buy opportunity on dollar/yen:

Here is their view, courtesy of eFXnews:

In a note to clients, Goldman Sachs discusses its FX view and strategy in light of today’s first Fed rate hike in nearly a decade.

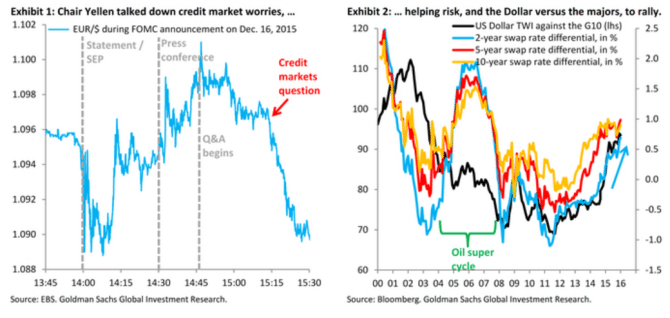

“The Fed today raised interest rates for the first time since 2006, without – as our economists note – resorting to an overly dovish message. This was very much in line with our “hike it and like it“ expectation and markets responded in the way we anticipated: the SPX bounced, EM currencies like the Mexican Peso strengthened, buoyed by the recovery in risk appetite, and the Dollar rose versus the G10,” GS notes.

“The turning point for price action came in the press conference, when Chair Yellen did not use a question on credit markets to head in a dovish direction, but emphasized the soundness of the financial system and strength of the economy instead,” GS adds.

“As we argued prior to the meeting, risk markets tend to take direction from the Fed when uncertainty is elevated, as in September when a dovish FOMC caused risk to sell off, while risk rallied on the hawkish October statement. This pattern held true today, as Chair Yellen’s upbeat message helped markets put aside worries over credit markets,” GS argues.

“The biggest beneficiary in G10 FX was $/JPY, which moved higher on a double lift via rate differentials and the relaxation in risk aversion. Into year-end, long $/JPY is our favorite expression of Dollar strength, as aggressive QQE implementation from the BoJ – 10-year JGB yields have been anchored at 30 bps through recent market gyrations – has on multiple occasions given rise to “phantom” moves higher in this cross, which we think reflect the power that QQE has on domestics shifting their portfolios out of JGBs into risk assets and out of the Yen,” GS advises.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.