Whether you are a sophisticated daily trader, an investment house senior analyst, or merely making your baby steps in the trading arena, learning to analyze instruments and markets is the cornerstone of your investment success. Nowadays, in the era of abundant data and advanced analysis technologies, there are various indicators that can be analyzed prior to entering a position, some require intensive number-crunching and others require you to look at a more high level qualitative aspects. One aspect that I really enjoy analyzing before entering a trade is the current market sentiment or namely Trends.

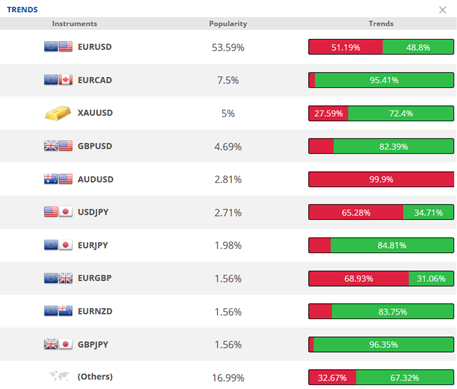

The financial markets’ instruments are traded, to some extent, subject to traders’ interpretation of the expected direction in which the market may go. Let’s take a look at the table below as an example which illustrates traders’ Buy / Sell tendency over a specific time window. This tendency outlines trends that may imply the markets expected direction.

Which Parameters Matter?

As illustrated above, there are a few parameters that are taken into account when analyzing trends. One fundamental figure is the Buy % and Sell % distribution of positions for each of the instruments. Another important parameter is Popularity, which represents the % of positions opened on a specific instrument out of the total positions opened. This figure may provide some general information related to liquidity, which has a tight connection to spreads. In addition, the higher an instrument’s popularity is, the more meaningful the Buy % and Sell % figures are and reflects traders’ tendencies. One last very important parameter is the time frame over which the data is collected.

Pay Attention!

Though the above information provides a clear idea of what the market current Trends are and which instruments are frequently traded, it doesn’t paint the full picture.

Current Trend vs. a Sentiment Change

While a trend reflects the overall market tendency over a time frame, using too long of a time frame may result in a lag in reflecting changes in the market sentiment as they occur. Say you want to trade GBP/USD. At first sight, the graph above shows that 82.39% of the trades are Buy, so that’s a very clear tendency. However, a closer look (not included here), may show that the trend has actually declined over the last 5 minutes and went down from a 95% to 82.39%. The sentiment then is changing and this means that traders are beginning to sell more, this may soon enough result in a reversed trend in favor of Sell.

Number of positions vs. Amount Traded

One may argue that since the Buy % and Sell % figures are of number of positions opened, they are inherently lacking the amounts traded in each direction and hence may be misleading. Say that over a time frame of 30 minutes, some 100 EUR/USD transactions are executed. 55 are a Buy with an average transaction size of EUR 10k and the other 45 transactions are Sell with an average size of EUR 26k. So while the sentiment will have a Buy inclination (55 to 45), the overall traded amount depicts a different story (1,170k vs 550k in favor of Sell).

Crowdsourcing

Another great tool to get a sense for market sentiment is Social Trading. As a trader, you may want to get an idea of the sentiment of just a segment of traders with specific characteristics (i.e. traders who specialize in specific markets or instruments, or traders with a long back dated and successful track record). With social trading, you can evaluate the movement of a select group of masters and may discover that while the market has a general tendency to a one direction, that individual or group are actually trading in the other direction.

Conclusion

As trading technologies evolve, more and more informative indicators become available to traders. One of these indicators is market Trends, which introduces some material information relating to traders’ tendencies and to markets’ general directions. It is valuable to take as many parameters as possible into account, or at the very least to fully understand the figures behind the trends as sometimes one cannot see the full picture at first sight.