The Australian central bank cut rates and the New Zealand one is expected to follow. However, the paths could be divergent, says the team at GS:

Here is their view, courtesy of eFXnews:

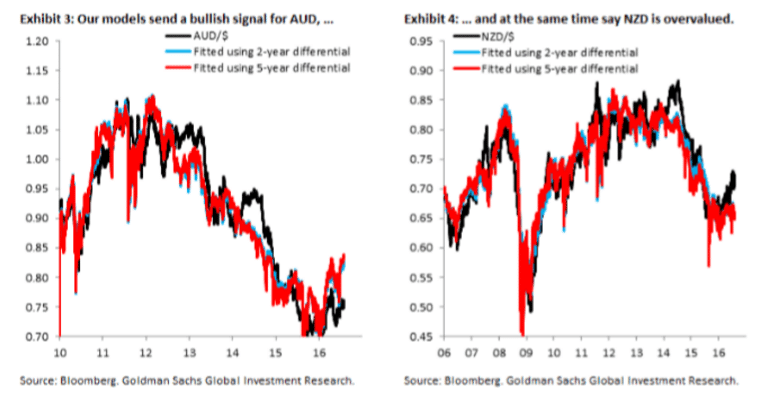

We periodically use regression models to map things like interest differentials, commodity prices, and risk appetite into exchange rates These models are always subject to a large grain of salt, but they can be helpful in digesting the myriad drivers of FX.

One of the primary signals that have come out of this exercise is that AUD/$ is too low relative to fundamentals, a signal that we highlighted end-May when AUD/$ was below 0.72. That signal is still active and puts the cross above 0.80.

This is in line with our economists, who recently switched to a more agnostic view, after being AUD bears for many years. Also, while a further RBA rate cut in November is possible, we do not see the odds as more than 50 percent, essentially in line with market pricing. In short, the path of least resistance is for AUD/$ to continue converging higher.

Our regression models give a different signal for NZD/$, which has failed to move lower with rate differentials and should see a catch-down. This message is compelling given that our economists forecast three rate cuts (this Thursday, November and March).

While the cut this coming week is priced, markets price 55 bps cumulatively through March, leaving room for an idiosyncratic NZD-weaker story. While uncertainty around the Fed and broad Dollar direction could buoy the currency, we think NZD should underperform vis-Ã -vis the AUD.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.