The Canadian dollar did not react positively to Trump’s Triumph. The team at Citi sees further downside risk:

Here is their view, courtesy of eFXnews:

We see three main drivers for CAD in the wake of Trump victory: 1) US fiscal policy and tax reform, 2) trade treaty discussions, and 3) rates differentials. All imply CAD bearishness in our view.

Firstly, with a Republican congress, Trump will be able to push through corporate tax reduction without increasing personal taxes as president Obama wanted. Together with repatriation, Trump tax policy may attract corporate capital flows from Canada and elsewhere to the US. On personal taxes, if as promised Trump reduces tax brackets and lower taxation for high earning individuals, high quality labor capital flows may be attracted to the US as well. Overall, implications from Trump’s tax initiatives are largely CAD negative.

Secondly, if Trump assigns a high priority to trade reform, the fear of global supply chain disruption will return to the market. Canada looks vulnerable as the biggest trade partner with the US. It is not clear that Canada has gained much from NAFTA, but that doesn’t mean that it will benefit if NAFTA falls apart. Uncertain outcomes from re-negotiation may weigh on Canadian exports and CAD going forward.

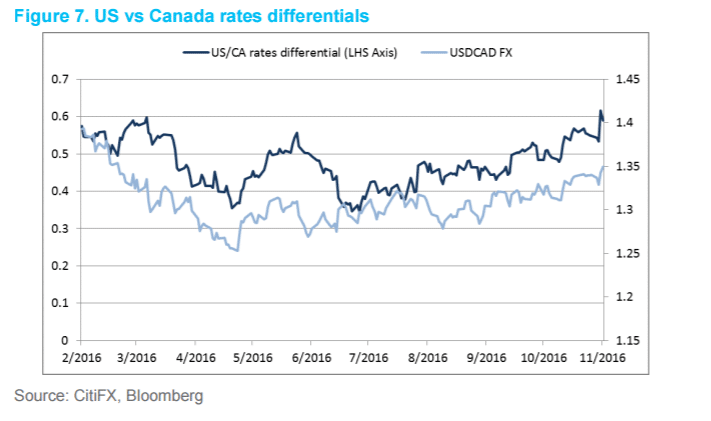

Lastly, rates differentials indicate USDCAD upside. Markets are pricing in more than 70% probability of December Fed hike and two more hikes by end of 2017. Citi economists call for a rate cut by the BoC by end of 2016 or early next year. Risk rally post the election added to the widened rates differential, which points to a higher USDCAD as shown in Figure 7 below.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.