The Fed always has excuses for low inflation in the present and foresees higher inflation in the future. The markets currently buy the optimism and send the dollar higher.

The optimism is reflected in the upbeat dot-plot: Yellen and co. are still set to raise rates in December and three more times in 2018. However, they did lower the long-term forecast to 2.8% from 3% last time.

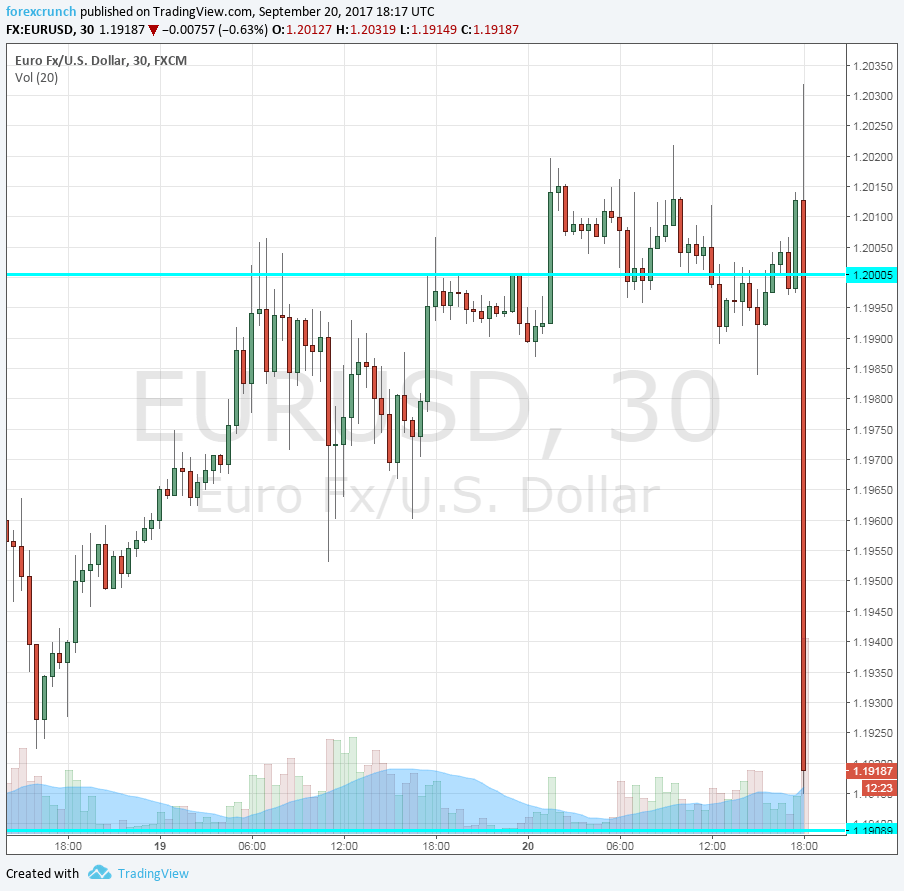

EUR/USD crashes from 1.20 to support at 1.1910. Further support awaits at 1.1870. Update: the pair continues lower, hitting a low of 1.1892. The pair reaches a low of 1.1885 but bounces to 1.19.

Further support awaits only at 1.1712. To the upside, we see 1.21.

Follow the live coverage of the all-important Fed decision

Yellen’s press conference is awaited. In the preview, we discussed the chances of Yellen reversing the course of the dollar.