The Australian dollar continued struggling and lost further ground leading into Easter. Will its fate turn around in the second quarter? Here are the highlights of the week and an updated technical analysis for AUD/USD.

Fears of a trade war actually waned ahead of the holiday, but the Aussie continued its downside slide. The RBA may like it. The continued drop of the pair mostly came from the American side: US GDP was upgraded to 2.9% annualized growth in Q4 2017, better than had been expected.

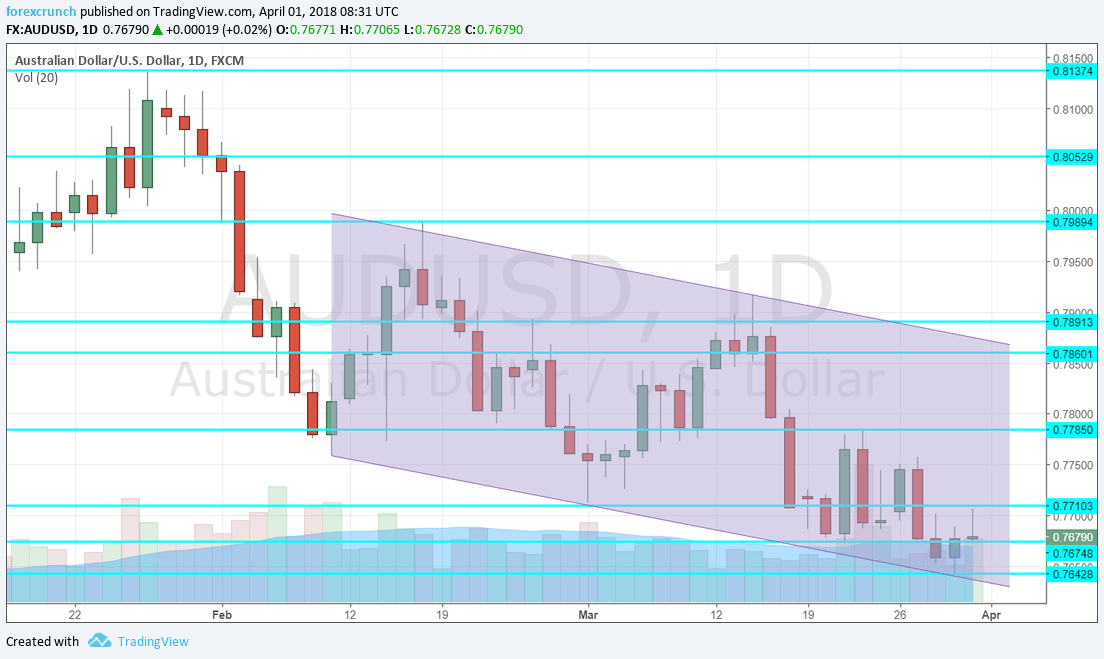

[do action=”autoupdate” tag=”AUDUSDUpdate”/]AUD/USD daily graph with support and resistance lines on it. Click to enlarge:

- MI Inflation Gauge: Monday, 1:00. The Australian authorities publish inflation figures only once per quarter, so this figure from the Melbourne Institute complements the data.

- Chinese Caixin Manufacturing PMI: Monday, 1:45. China is Australia’s No.1 trading partner and the independent forward-looking gauge for the Chinese economy impacts the Aussie. In February, the indicator stood at 51.6 points. An increase to 51.8 is on the cards now.

- AIG Manufacturing Index: Monday, 23:30. The Australian Industry Group’s measure showed robust growth in the manufacturing sector: 57.5 points, significantly above the 50-point threshold that separates growth from contraction. A slide could be seen now.

- ANZ Job Advertisements: Tuesday, 1:30. The Australia New Zealand bank’s gauge of jobs dropped by 0.3% in February. This early indicator of the labor market may tick up in March.

- Rate decision: Tuesday, 4:30. The Reserve Bank of Australia has not changed its interest rates since 2016 and this March decision is unlikely to be very different with a consensus that the interest rate remains at 1.50%. The team led by Phillip Lowe will likely continue saying that the high value of the currency weighs on reaching the inflation goal despite the recent drop of the A$ against the greenback. Household debt and the slow pace of growth in wages are sources of worry while the relatively low unemployment rate and exports are still doing well. Any change in the tone may move the Aussie as expectations are very low for any kind of move. Markets predict no rate hikes in 2018.

- Commodity Prices: Tuesday, 6:30. As a commodity exporter, this monthly measure of commodity prices has an impact, even though prices of key metals change on a daily basis. A y/y drop of 1% was recorded in February.

- Retail Sales: Wednesday, 1:30. The volume of retail sales rose by a disappointing rate of 0.1% in February, providing evidence that internal consumption is not going anywhere fast. A faster growth rate of 0.3% is on the cards now.

- Building Approvals: Wednesday, 1:30. The change in building consents is somewhat volatile, but still provides a snapshot of the construction sector. After a jump of 17.1% in January, a drop of 4.8% is on the cards now.

- AIG Services Index: Wednesday, 23:30. This forward-looking index has shown OK growth in February: 54 points. A similar number is likely now.

- Trade Balance: Thursday, 1:30. Australia surprised with a wide surplus in its trade balance in January: A$1.06. A narrower surplus is on the cards now: 0.72 billion.

*All times are GMT

AUD/USD Technical Analysis

Aussie/USD started off the week with an attempt to move to the upside but struggled and fell to the lowest levels since December, nearing the 0.7650 level mentioned last week.

Technical lines from top to bottom:

0.8050 capped the pair in August and also temporarily in January, on its way up. 0.7990 was the high point in February and protects the 0.80 level.

0.7890 worked as support in February and resistance in October. 0.7780 capped the pair in late March and also was a pivotal line in February.

The round level of 0.7710 was resistance in December and also in March. The new low of 0.7675 is next.

Lower, 0.7650 worked as resistance in several occasions in late 2017. The last line to watch is the round 0.75 level.

Downtrend channel

As the chart shows, the pair is trading in a downtrend channel. This is a bearish sign.

I remain bearish on AUD/USD

The US Dollar is gaining its footing once again and the Australian dollar does not have anything to offer against it.

Our latest podcast is titled Fed Day and Underwhelming Oil

Follow us on Sticher or iTunes

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – projections for dollar/yen

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!