- The pair trims losses and rebounds to the 1.1760 region.

- After recording fresh YTD tops, the greenback eases some ground.

- Fedspeak, FOMC, ECB minutes to drive sentiment this week.

After bottoming out in fresh 2018 lows in the vicinity of 1.1710 in early trade, EUR/USD has now sparked a squeeze higher to the 1.1750/60 band.

EUR/USD looks to Fedspeak, Italy

The pair has now regained some attention after recording fresh multi-month lows in the proximity of 1.1710, at the same time breaking below the critical support at 1.1718 (monthly low December 2017).

The continuation of the USD-rally lifted the US Dollar Index (DXY) to levels above 94.00 the figure earlier in the session – zone last visited in December 2017 – albeit it receded some ground soon afterwards.

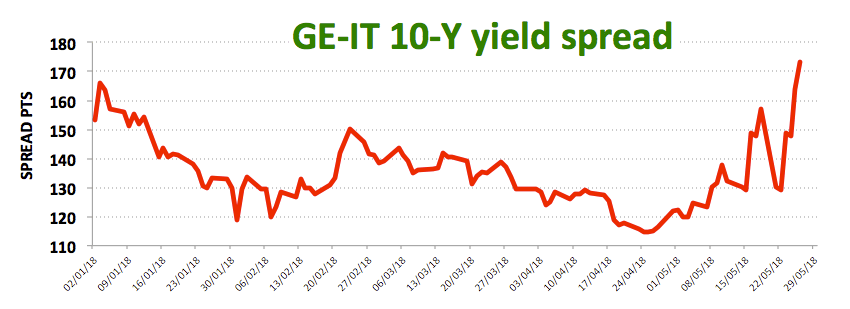

In addition, the most-likely formation of a populist government in Italy and the imminent announcement of the PM at some point later today is also weighing on the European currency.

Later in the week, advanced PMIs in Euroland and the publication of the FOMC minutes are expected on Wednesday, seconded by the ECB minutes on Thursday and the German IFO, US Durable Goods Orders and the speech by Fed’s J.Powell all due on Friday.

EUR/USD levels to watch

At the moment, the pair is losing 0.20% at 1.1748 and a breakdown of 1.1717 (2018 low May 21) would target 1.1700 (psychology level) en route to 1.1553 (monthly low Nov. 7 2017). On the flip side, the next resistance aligns at 1.1846 (10-day sma) seconded by 1.1961 (21-day sma) and finally 1.1996 (high May 14).