- The pair advances to the 111.40 region, multi-month tops.

- Yields of the key US 10-year note rebound to the 3.08% area.

- Fedspeak, FOMC minutes in the limelight later in the week.

The rally in the greenback continues to support the up move in USD/JPY, this time climbing to the 111.40 zone, or fresh 4-month peaks.

USD/JPY looks to yields

Spot is so far advancing for the ninth consecutive week, gaining almost 7% since yearly lows in the mid-104.00s recorded in late March and always on the back of the better tone in the buck, which in turn appears supported by rising US yields.

In addition, easing geopolitical concerns, diminished chances of a trade war between China and the US and the continuation of the ultra-loose stance from the Bank of Japan are all also collaborating with the upside in the pair.

In the US data space, speeches by Atlanta Fed R.Bostic (voter, centrist), Philladelphia Fed P.Harker (non voter, hawkish) and Minneapolis Fed N.Kashkari (non voter, dovish) are likely to keep the attention on the buck later in the day.

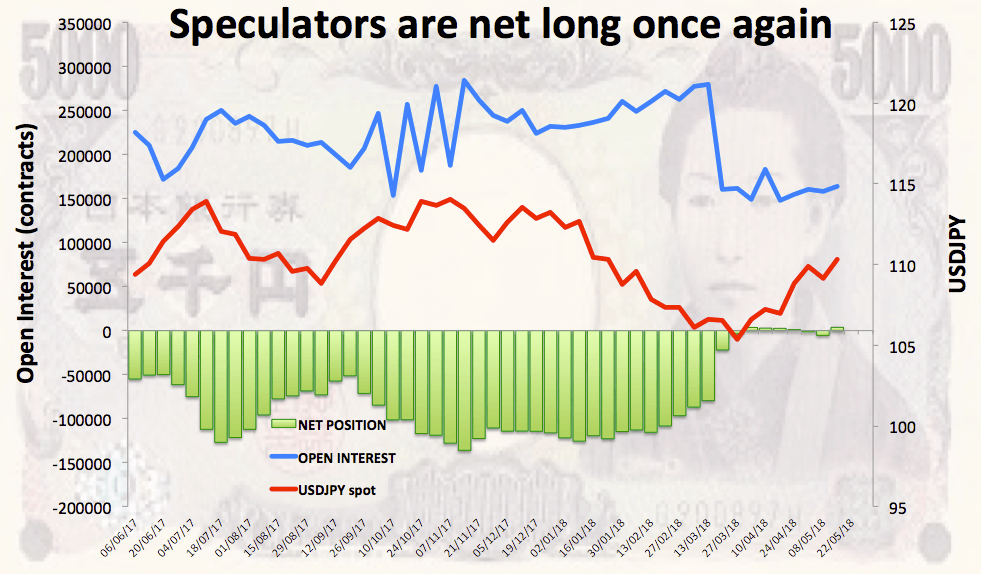

On the positioning front, speculators once again turned net longs on the safe haven JPY on the week to May 15, as per the latest CFTC report.

USD/JPY levels to consider

As of writing the pair is gaining 0.44% at 111.26 and a break above 111.40 (high May 21) would open the door to 111.50 (high Jan.18) and finally 113.39 (2018 high Jan.8). On the downside, immediate contention is located at 110.21 (200-day sma) followed by 110.08 (10-day sma) and then 108.64 (low May 4).