- Mnuchin said that the trade war is “on hold” which sparks risk-on mood across the board.

- China agrees to buy more US goods to help narrow the trade deficit between the US and China.

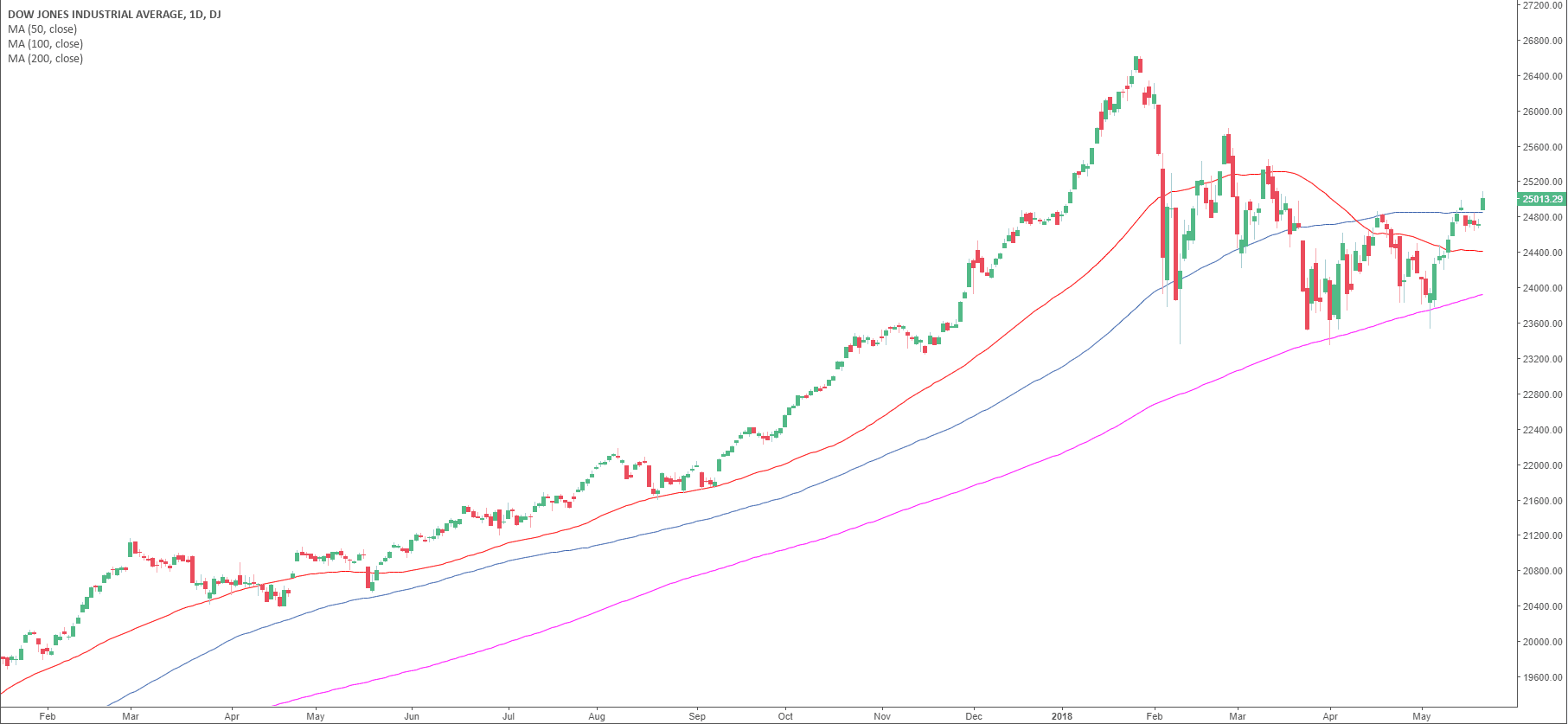

The S&P rose 0.74% to 2,733.01 while the Dow Jones Industrial Average gained 1.21% to 25,013.29. The tech-heavy Nasdaq rose 0.54% to 7,394.04.

Risk-on mood prevailed on the main US indices as the second round of talks between the US and China were “positive, pragmatic, constructive and productive” according to Chinese Vice Premier Liu He.

In fact, the US and China have been at odds concerning trade tariffs. The two largest economies have failed to find an agreement in recent months and stock markets have been rather concerned by the international trade conflict.

Mnuchin, US Treasury Secretary said over the weekend: “we are putting the trade war on hold. Right now, we have agreed to put the tariffs on hold while we try to execute the framework.” However, it is worth noting that Robert Lighthizer, US Trade Representative released a conflicting statement which said that Washington may still resort to tariffs. Nevertheless, Mnuchin insisted that the White House “is unified after agreeing over the weekend not to impose tariffs on China.”

China said to agree to buy more US goods to help narrow the trade deficit between the two countries but didn’t agree to the specific U.S. target of $200 billion.

“Any headline that suggests a trade war with China is less likely is market positive. During earnings season, many companies have cited trade tensions as a major uncertainty for the back half of the 2018; therefore, all news suggesting otherwise will be greeted happily by shareholders,” commented Jamie Cox, at Harris Financial Group.

Meanwhile, the 10-year Treasury yield benchmark retreated again on Monday and is trading in the 3.060% region. Lower yields are generally positive for stocks.

Dow Jones daily chart

The market is trading above its 50, 100 and 200-period simple moving average which suggests an upward bias. Support is seen at the 24,600 swing low and at 24,400 demand level. To the upside, resistance is seen at 24,450 and 25,800 swing highs.