- Cable loses further momentum and records fresh 2018 lows.

- Today’s decline opens the door for a test of the 1.3300 handle.

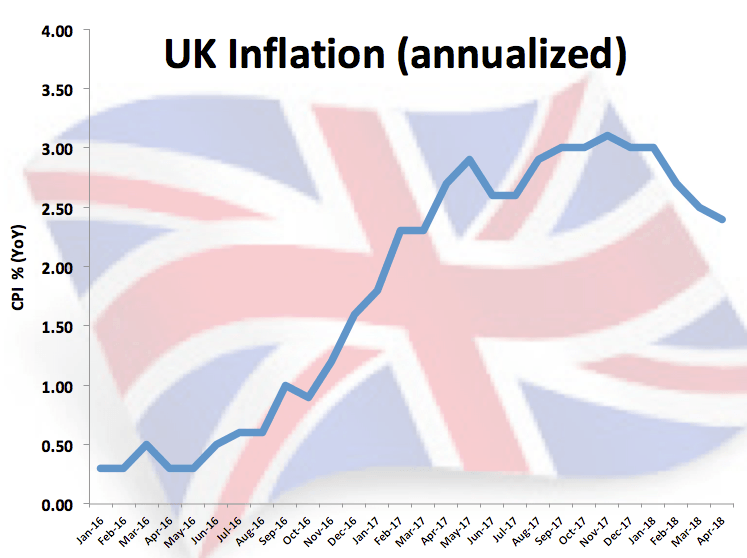

- UK CPI rose at an annualized 2.4% in April, less than expected.

The offered tone around the Sterling is now gathering further traction and is forcing GBP/USD to recede to the mid-1.3300s, recording fresh 2018 lows at the same time.

GBP/USD weaker post-CPI

Cable slipped back to the 1.3350 area after UK consumer prices tracked by the headline CPI rose 2.4% on a year to April and 0.4% inter-month, both prints coming in below estimates.

In addition, consumer prices stripping food and energy costs rose 2.1% on a yearly basis, also missing initial forecasts.

Cable has now faded the yearly rally and has closed in the negative territory in five out of the last six weeks, prolonging the rejection from 2018 tops near 1.4380 seen in mid-April, all against the backdrop of disappointing UK data and diminished expectations of a rate hike by the BoE in the near term.

GBP/USD levels to consider

As of writing, the pair is losing 0.50% at 1.3365 facing initial contention at 1.3347 (2018 low May 23) seconded by 1.3302 (monthly low Dec.18) and finally 1.3039 (monthly low Nov.3 2017). On the upside, a break above 1.3484 (10-day sma) would open the door to 1.3570 (200-day sma) and then 1.3658 (2017 high Sep.20).