- Crude oil prices drop to the $71.30 area post-EIA report.

- WTI stays toppish near 4-year peaks.

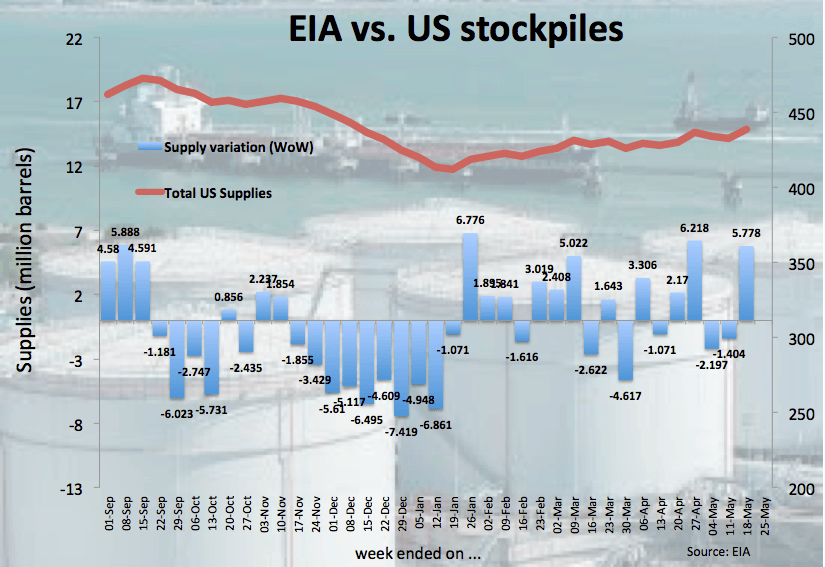

- US crude oil inventories rose by around 5.8 mbpd last week.

Prices of the barrel of the American reference for the sweet light crude oil are losing further ground today, testing daily lows in the $71.30 region following the latest EIA report.

WTI weaker on upbeat EIA

Prices of the West Texas Intermediate are easing from the area above the critical $72.00 mark after the EIA reported US crude oil supplies unexpectedly increased more than initially forecasted by 5.778 mbpd during the week ended on May 18.

Furthermore, Weekly Distillate Stocks dropped by 0.951 mbpd and Gasoline inventories went up by 1.883 mbpd, coming in below prior forecasts.

In addition, supplies at Cushing diminished by 1.123 mbpd, adding to last week’s 0.053 mbpd build.

In the meantime, prices of the barrel of WTI are managing well to keep the trade in the upper end of the recent range, always underpinned by the potential US sanctions against Iran, the deteriorating situation in Venezuela and geopolitical effervescence in the Middle East.

WTI significant levels

At the moment the barrel of WTI is losing 1.03% at $71.28 facing the next down barrier at $70.12 (21-day sma) followed by $67.65 (low May 8) and finally $66.86 (low May 1). On the flip side, a breakout of $72.80 (2018 high May 22) would open the door to $73.00 (psychological level) and then $77.77 (high Nov.21 2014).