- UK retail sales bounced back in April, but investors are not impressed.

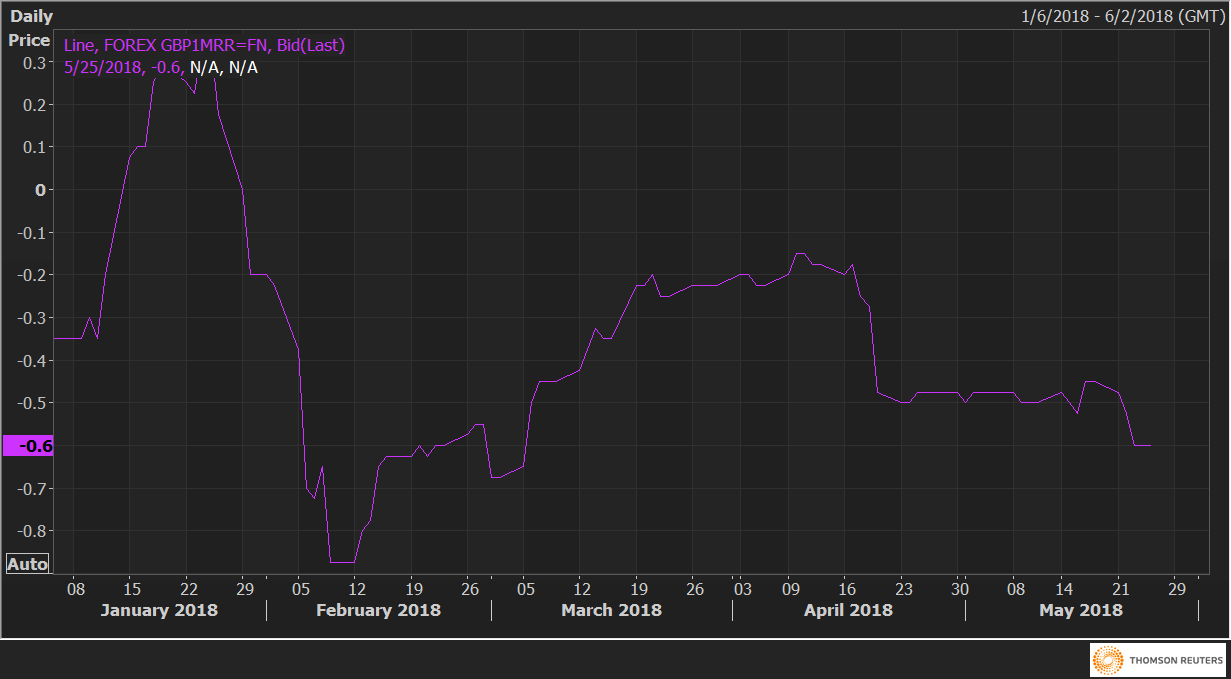

- Risk reversals show GBP put bias is intact.

The UK retail sales rose by a better-than-expected 1.6% in April, the Office for National Statistics reported on Thursday.

In response, the GBP/USD pair posted moderate gains and created a bullish inside-day candle. However, the options market retains its bearish view on GBP.

The one-month 25 delta risk reversals remained flatlined at -0.60 – the lowest level since early March. A pick up in risk reversals (a drop in the implied volatility premium for GBP puts) would have meant the investors expect GBP to build on the post-retail sales gains.

However, the stagnant risk reversals indicate the investors believe the post-retail sales gains in GBP will be short-lived.

GBP1MRR