- The main theme of the week was the geopolitical fears related to US-China trade war and the US-North Korea summit canceled.

- The main US stock indices end the week in the green despite geopolitical turmoil as markets focus on earnings.

- Gold broke above the $1,300/oz while crude oil WTI fell below the $68 per barrel on fears of rising production.

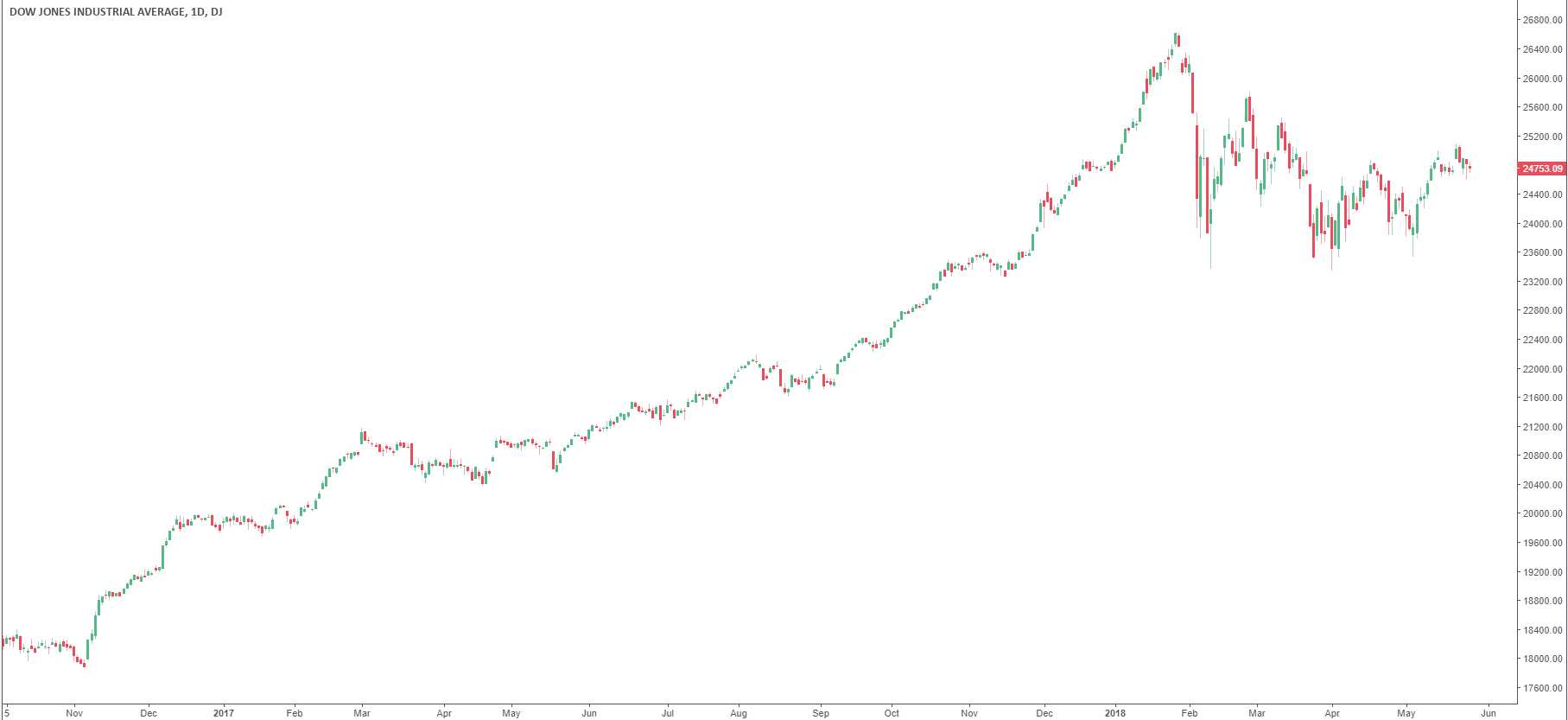

The S&P 500 lost 0.24% to 2,721.33 while the Dow Jones Industrial Average equally dropped 0.24% to 24,753.09. The Nasdaq Composite Index gained 0.13% to 7,433.85 on Friday.

The week started with the news that the discussions between US and China were “put on hold”. The news broke out a few days before the second round of talks between the two biggest economies. Later in the week, US President Trump said that he was not satisfied with the trade talks. He later announced that he was planning on imposing 25% tariffs on imported vehicles to the US.

What also spooked markets (on Thursday) was the news that Trump canceled the summit with the North Korean dictator Kim Jong Un which was planned on June 12 in Singapore. The news sent stocks lower and gold past the $1,300 a troy ounce level.

However, analysts argue that the markets have priced in the geopolitical risk and investors are focusing on earnings instead.

Friday saw crude oil WTI melt more than 4% as the OPEC is contemplating the idea to increase production levels of up to 1 million barrels a day in order to compensate for the Venezuelan production drop. Indeed, the country is in deep crisis and its oil production is at a 70-year low. The news sent WTI below the $68 a barrel mark.

Dow Jones: daily chart