The German IFO Business Climate Overview

The German IFO surveys for May are lined up for release later today at 0800 GMT. The headline IFO Business Climate Index is expected to come in a tad weaker at 102.0 in May. The Current Assessment sub-index is also seen lower at 105.5 this month, while the IFO Expectations Index – indicating firms’ projections for the next six months – is likely to ease to 98.5 in the reported month.

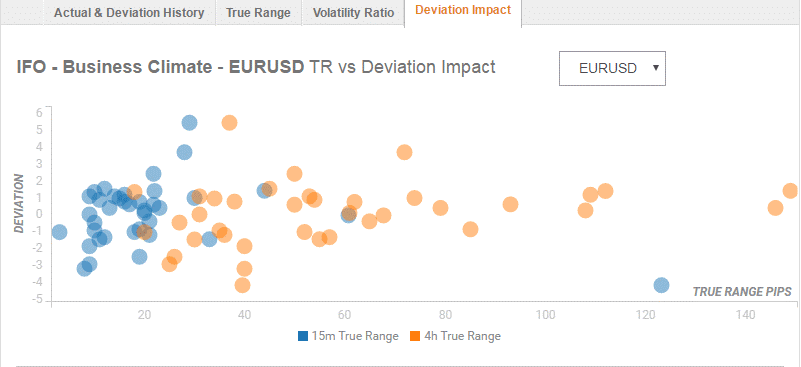

Deviation impact on EUR/USD

Readers can find FX Street’s proprietary deviation impact map of the event below. As observed the reaction is likely to remain confined between 3 and 40 pips in deviations up to 2.4 to -3.2, although in some cases, if notable enough, a deviation can fuel movements of up to 60 pips.

How could affect EUR/USD?

The spot could drop back to test the multi-month lows at 1.1676 on a bigger-than-expected drop in IFO figures while the EUR/USD pair could swing back towards 1.1750 on a positive surprise.

According to Haresh Menghani, Analyst at FXStreet, “A convincing break below the 1.1700-1.1690 region now seems to pave the way for an extension of the slide towards testing 1.1580 support with some intermediate stoppages near 1.1660 horizontal level and the 1.1600 handle. On the upside, recovery attempts might continue to confront some fresh supply near mid-1.1700s, above which a bout of short-covering now seems to assist the pair to head back towards reclaiming the 1.1800 round figure mark.”

However, the reaction to the data is likely to be short-lived, as the sentiment around the US dollar price-action as well as the risk trends will remain the main driver for the major.

Key Notes

Forex Today: Yen corrects lower in Asia, German IFO, UK growth figures eyed

EUR/USD weaker, challenges 1.1700 ahead of IFO

European FX Outlook: German Ifo business climate and first revision of UK GDP headline

About the German IFO Business Climate

This German business sentiment index released by the CESifo Group is closely watched as an early indicator of current conditions and business expectations in Germany. The Institute surveys more than 7,000 enterprises on their assessment of the business situation and their short-term planning. The positive economic growth anticipates bullish movements for the EUR, while a low reading is seen as negative (or bearish).