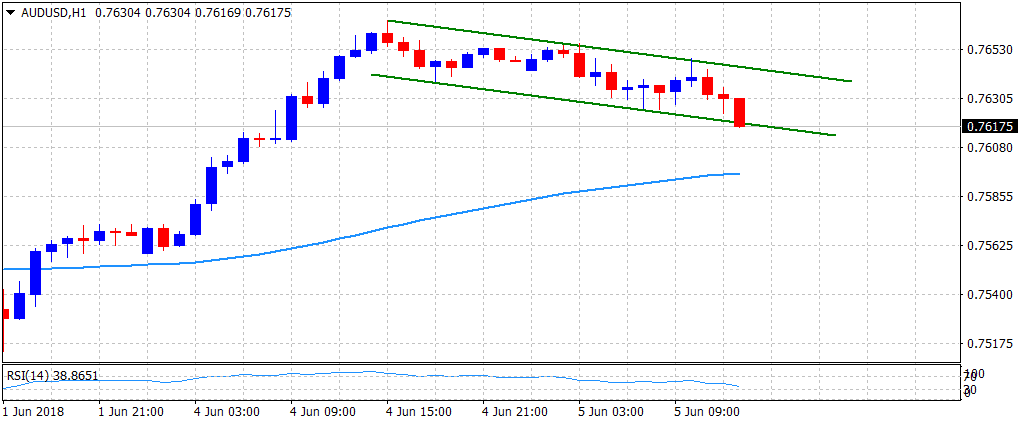

“¢ The pair has been corrective from 100-day SMA alongside a descending trend-channel formation on 1-hourly chart.

“¢ A convincing break would negate a bullish flag chart pattern and expose 200-hour SMA, sub-0.7600 level.

“¢ Reviving USD demand might continue to keep a lid on any meaningful up-move ahead of US ISM non-manufacturing PMI.

Spot Rate: 0.7618

Daily High: 0.7656

Trend: turning bearish again

Resistance

R1: 0.7643 (23.6% Fibonacci retracement level)

R2: 0.7669 (100-day SMA)

R3: 0.7701 (round figure mark and 200-day SMA)

Support

S1: 0.7583 (S1 daily pivot-point)

S2: 0.7568 (200-hour SMA)

S3: 0.7539 (20-day SMA)