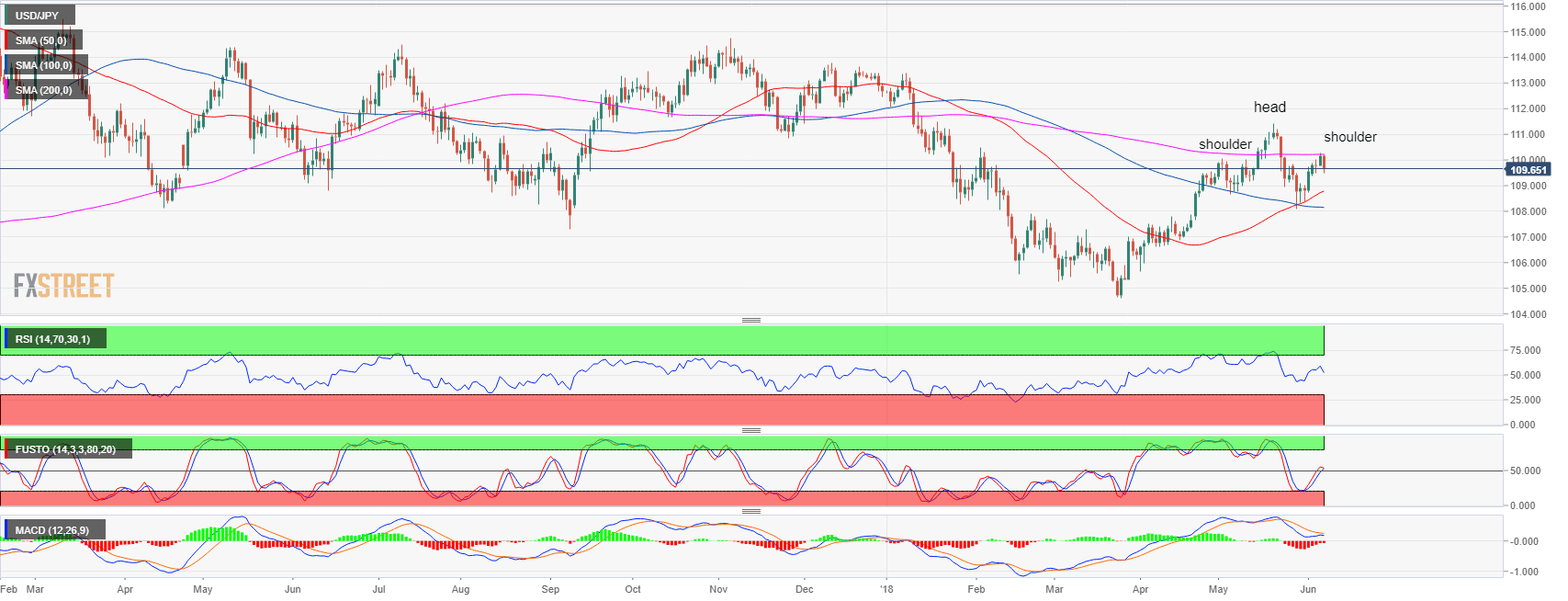

- USD/JPY is potentially forming a bearish head-and-shoulder pattern on the daily time-frame.

- Near-term USD/JPY is essentially range-bound between 109.40 and 110.25 so a potential rebound in the 110.00 area and a retest of the 100-period simple moving average (M15) can be possible.

- However, USD/JPY remains exposed to further losses and a strong bear breakout below the 109.37-109.47 area would likely confirm the bearish reversal.

USD/JPY 15-minute chart

Spot rate: 109.69

Relative change: -0.45%

High: 110.24

Low: 109.47

Trend: Bearish below 109.37-109.47 area

Resistance 1: 110.00-110.21 area, figure, daily 200 SMA

Resistance 2: 110.79 May 22 low

Resistance 3: 111.41 May 21 high

Support 1: 109.37/47 current Thursday’s low, daily 10 SMA

Support 2: 109.20, 50% Fibonacci retracement from May 29-June 6

Support 3: 108.76, daily 50 moving average

USD/JPY daily

Potential bearish head-and-shoulder formation.

-636639980851532044.png)