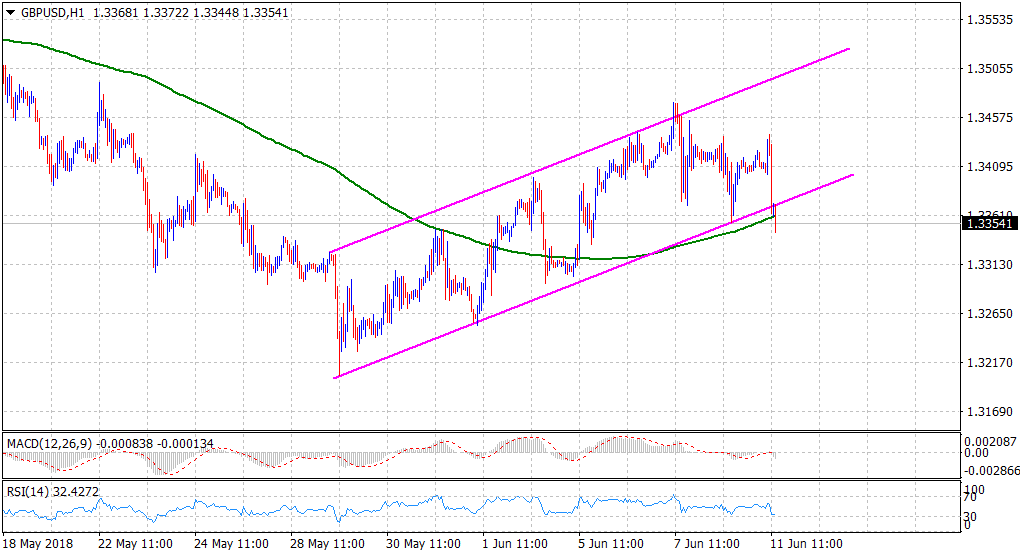

“¢ Poor UK manufacturing/industrial production data prompts some aggressive GBP selling, dragging the pair below Friday’s swing low and a short-term ascending trend-channel.

“¢ A subsequent fall below 200-period SMA on hourly chart reinforces a short-term bearish breakdown and paves the way for a further near-term depreciating slide.

“¢ Short-term technical indicators – RSI and MACD, point to additional weakness, especially against the backdrop the recent Brexit rhetoric.

Spot Rate: 1.3354

Daily High: 1.3441

Trend: Bearish

Resistance

R1: 1.3361 (200-period SMA H1)

R2: 1.3401 (daily pivot-point)

R3: 1.3441 (daily high)

Support

S1: 1.3315 (S2 daily pivot-point)

S2: 1.3300 (round figure mark)

S3: 1.3254 (June 1 swing low)