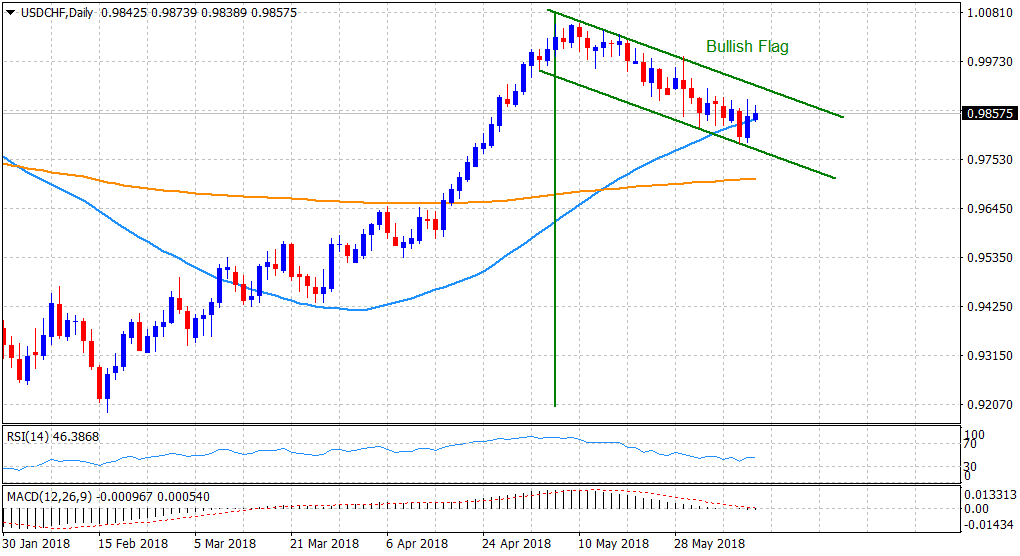

“¢ Diverging technical indicators now seemed to keep a lid on last week’s rebound from bullish flag support and any meaningful momentum beyond 50-day SMA.

“¢ A strong follow-through buying above the 0.9900-0.9910 immediate strong hurdle needed to increase prospects of any further near-term up-move.

“¢ The 0.9800 handle might continue to protect the immediate downside ahead of this week’s key event risk – the latest FOMC monetary policy update.

Spot Rate: 0.9858

Daily High: 0.9874

Daily Low: 0.9839

Trend: Sideways

Resistance

R1: 0.9896 (R1 daily pivot-point)

R2: 0.9918 (bullish flag resistance)

R3: 0.9941 (200-period SMA H4)

Support

S1: 0.9800 (round figure mark)

S2: 0.9773 (bullish flag support)

S3: 0.9711 (200-day SMA)