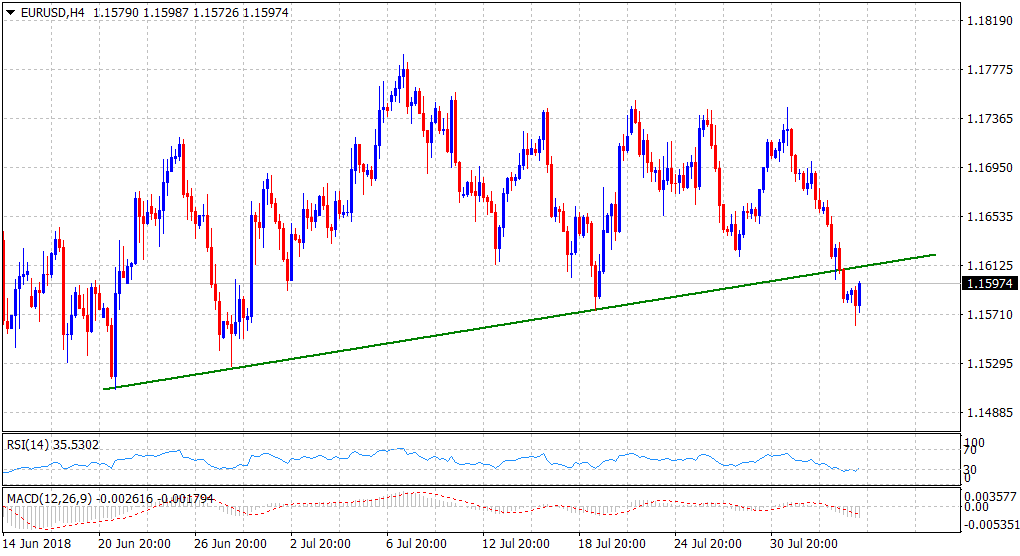

“¢ The pair extended overnight bearish break below a short-term ascending trend-line support and weakened farther below the 1.1600 handle on Friday.

“¢ Technical indicators on the hourly charts drifted into oversold territory and could be the only possible reason behind a modest rebound seen over the past few hours.

“¢ However, given the bearish set-up, the current recovery might still be seen as a dead-cat bounce and could attract some aggressive selling at higher levels.

“¢ A slightly better-than-expected NFP print will be enough to prompt fresh selling and drag the pair back towards YTD lows, closer to the key 1.1500 psychological mark.

EUR/USD 4-hourly chart

Spot Rate: 1.1597

Daily Low: 1.1562

Trend: Bearish

Support

S1: 1.1555 (S1 daily pivot-point)

S2: 1.1508 (YTD low set on June 21)

S3: 1.1479 (July 20, 2017 swing low)

Resistance

R1: 1.1615 (ascending trend-line support break-point)

R2: 1.1667 (100-period SMA H1)

R3: 1.1698 (R2 daily pivot-point)