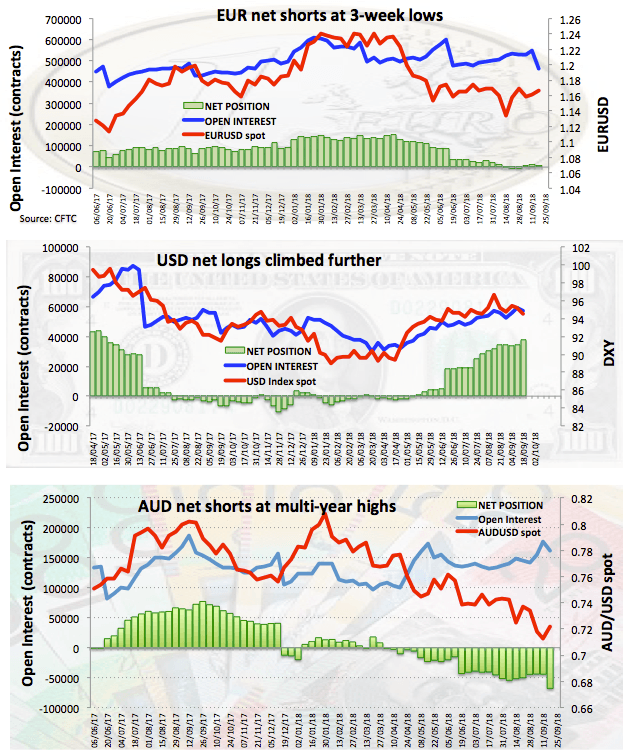

These are the main highlights of the latest CFTC positioning report for the week ended on September 18.

- USD net longs climbed once again to the highest level since May 2 2017. Despite easing concerns in the EM FX universe and with the bad news on the US-China trade front almost priced in, speculators kept looking to the buck ahead of the key FOMC meeting tomorrow.

- Speculators added more than 11K contracts to their EUR gross shorts positions, taking the net longs to fresh 3-week lows, always against the backdrop of the steady ECB, trade jitters and the likeness of a rate hike by the Fed.

- AUD net shorts increased to the highest level since early September 2013 in response to heightened concerns over a trade war and lack of news in the outlook from the RBA.