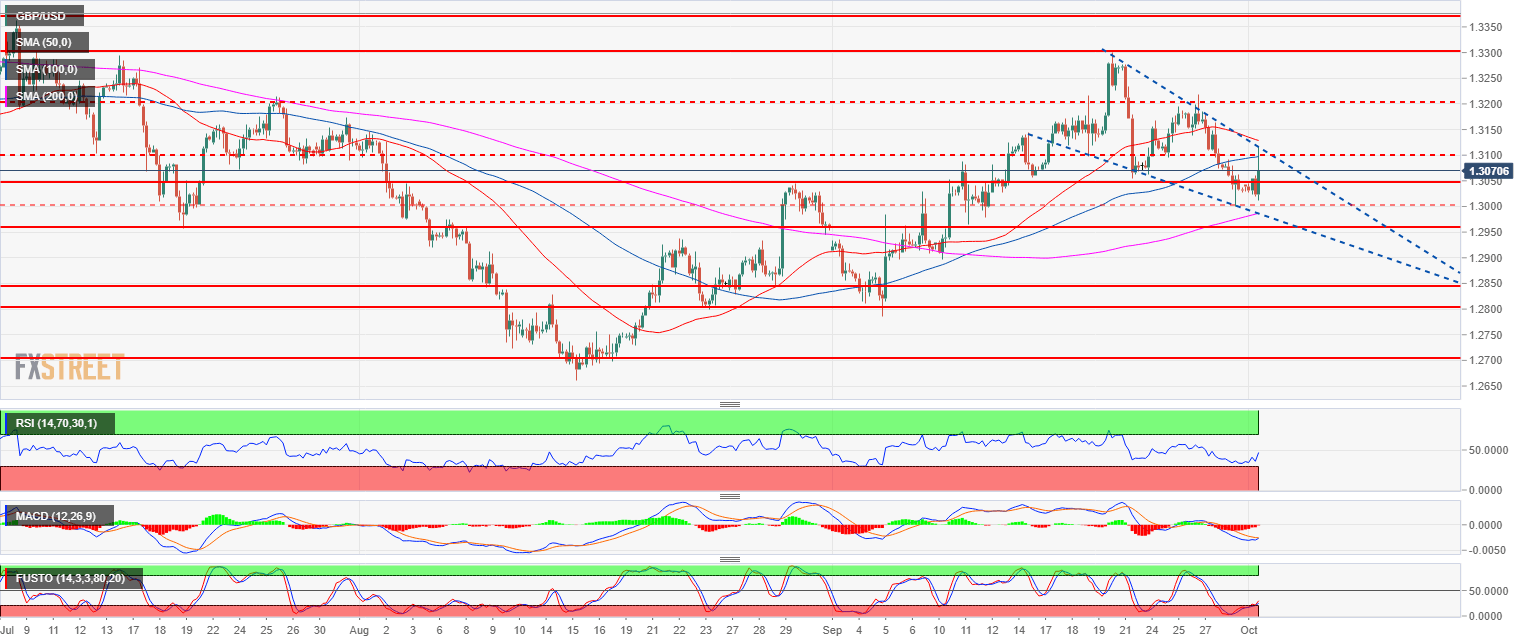

- GBP/USD is consolidating the recent gains in a bull flag.

- GBP/USD is trading below its 50 and 100-period simple moving averages (SMA) while it is holding above the 200 SMA and the 1.3000 figure. The RSI, MACD and Stochastics indicators are starting to rise.

- However, the market might need to consolidate some more with maybe a test or the 200 SMA and the 1.3000 figure before big bulls come back and lift the market once more.

Spot rate: 1.3072

Relative change: 0.33%

High: 1.3116

Low: 1.3012

Main trend: Bullish

Short-term trend: Neutral

Resistance 1: 1.3100 figure

Resistance 2: 1.3144 key level

Resistance 3: 1.3200 figure (key support/resistance)

Resistance 4: 1.3300 figure

Resistance 5: 1.3363 July high

Resistance 6: 1.3472 June 7 high

Support 1: 1.3050 August 30 swing high, key level

Support 2: 1.3000 figure

Support 3: 1.2957 July 19 swing low

Support 4: 1.2900 figure