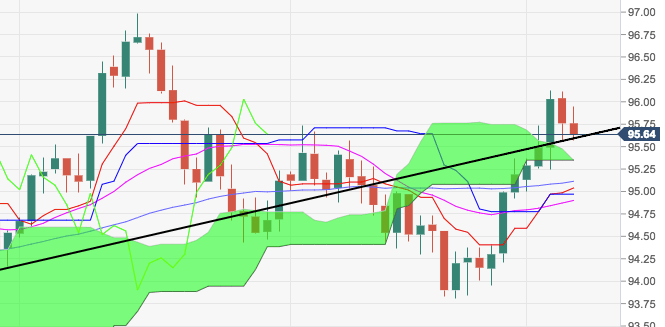

- DXY is losing further momentum in the wake of the release of September’s Non-farm Payrolls, although the decline appears to have met decent support in the boundaries of the key short-term support line around 95.60.

- As long as this line holds, another test of recent tops beyond 96.00 the figure and the 50% Fibo retracement of the 2017-2018 drop at 96.04 is not ruled out in the near term.

- A break below this support zone should see of this region should see the 55-day SMA at 95.11 and the 10-day SMA at 95.05 retested

DXY daily chart

Dollar Index Spot

Overview:

Last Price: 95.63

Daily change: -13 pips

Daily change: -0.136%

Daily Open: 95.76

Trends:

Daily SMA20: 94.86

Daily SMA50: 95.15

Daily SMA100: 94.77

Daily SMA200: 92.67

Levels:

Daily High: 96.12

Daily Low: 95.56

Weekly High: 95.37

Weekly Low: 93.84

Monthly High: 95.74

Monthly Low: 93.81

Daily Fibonacci 38.2%: 95.77

Daily Fibonacci 61.8%: 95.91

Daily Pivot Point S1: 95.51

Daily Pivot Point S2: 95.25

Daily Pivot Point S3: 94.95

Daily Pivot Point R1: 96.07

Daily Pivot Point R2: 96.37

Daily Pivot Point R3: 96.63