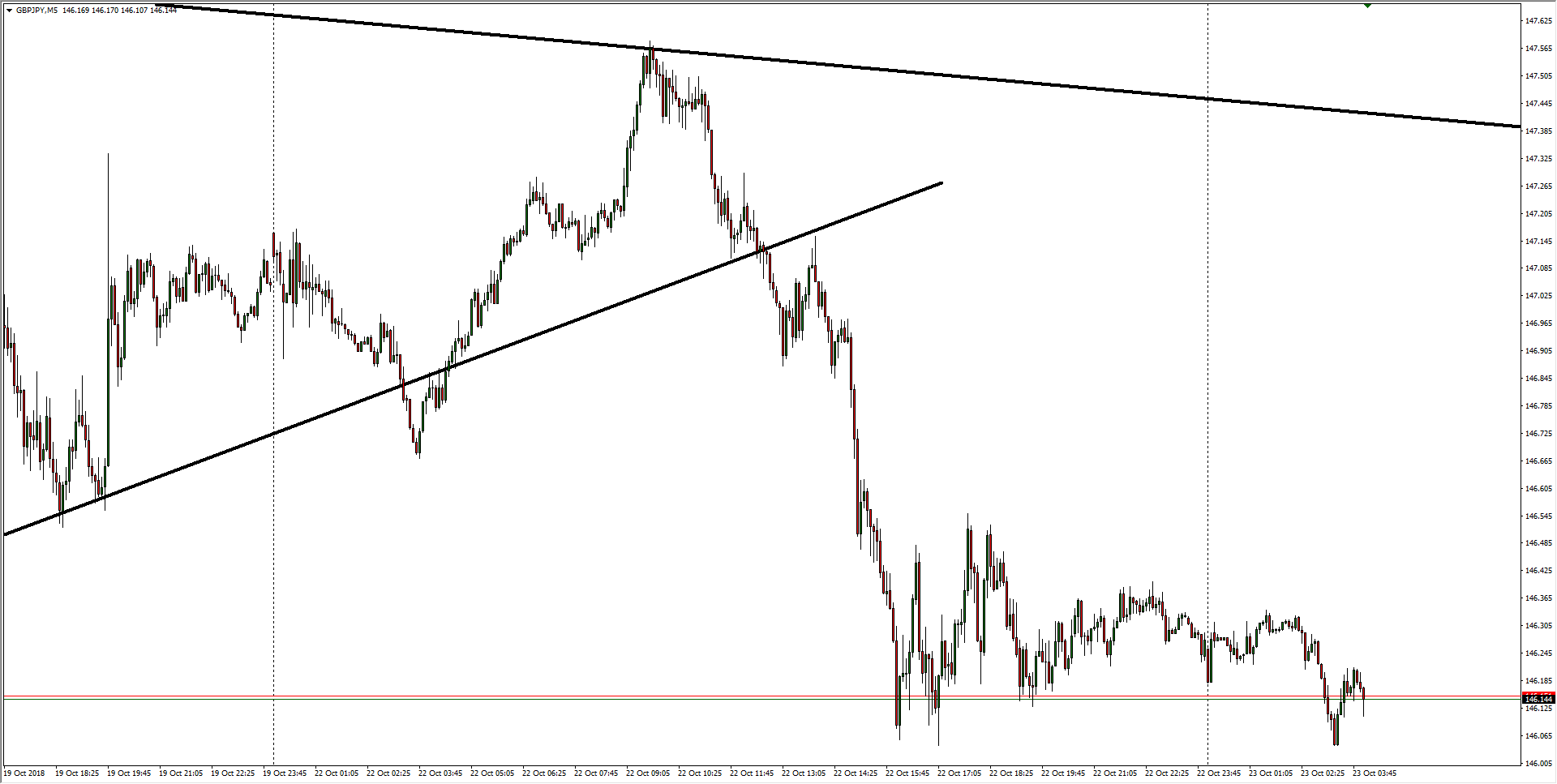

The past twenty-four hours have seen the GBP/JPY make a bearish break of the pair’s rising trendline from last week, and the Guppy is now setting up the groundwork for fresh support just above the 146.00 handle as the Pound gets punished in broader markets at the hands of continued Brexit headlines, where disheartened bullish hopefuls continue to get left out in the cold.

GBP/JPY, M5

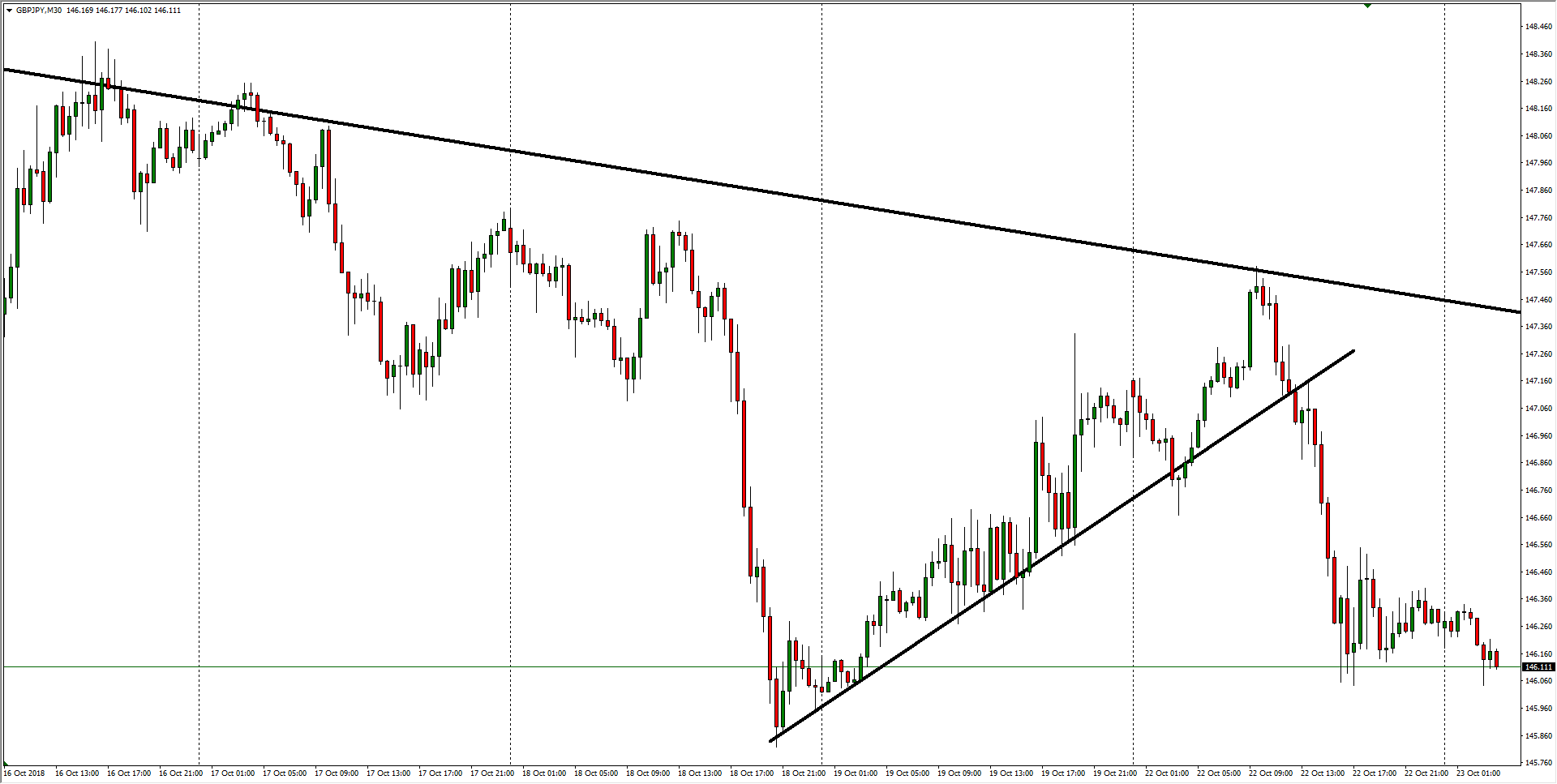

The past week sees the Guppy’s declining trendline further cementing itself after Monday’s rejection from the 147.50 region, and the GBP/JPY could be set for a continued decline as the pair flashes further bearish signals.

GBP/JPY, M30

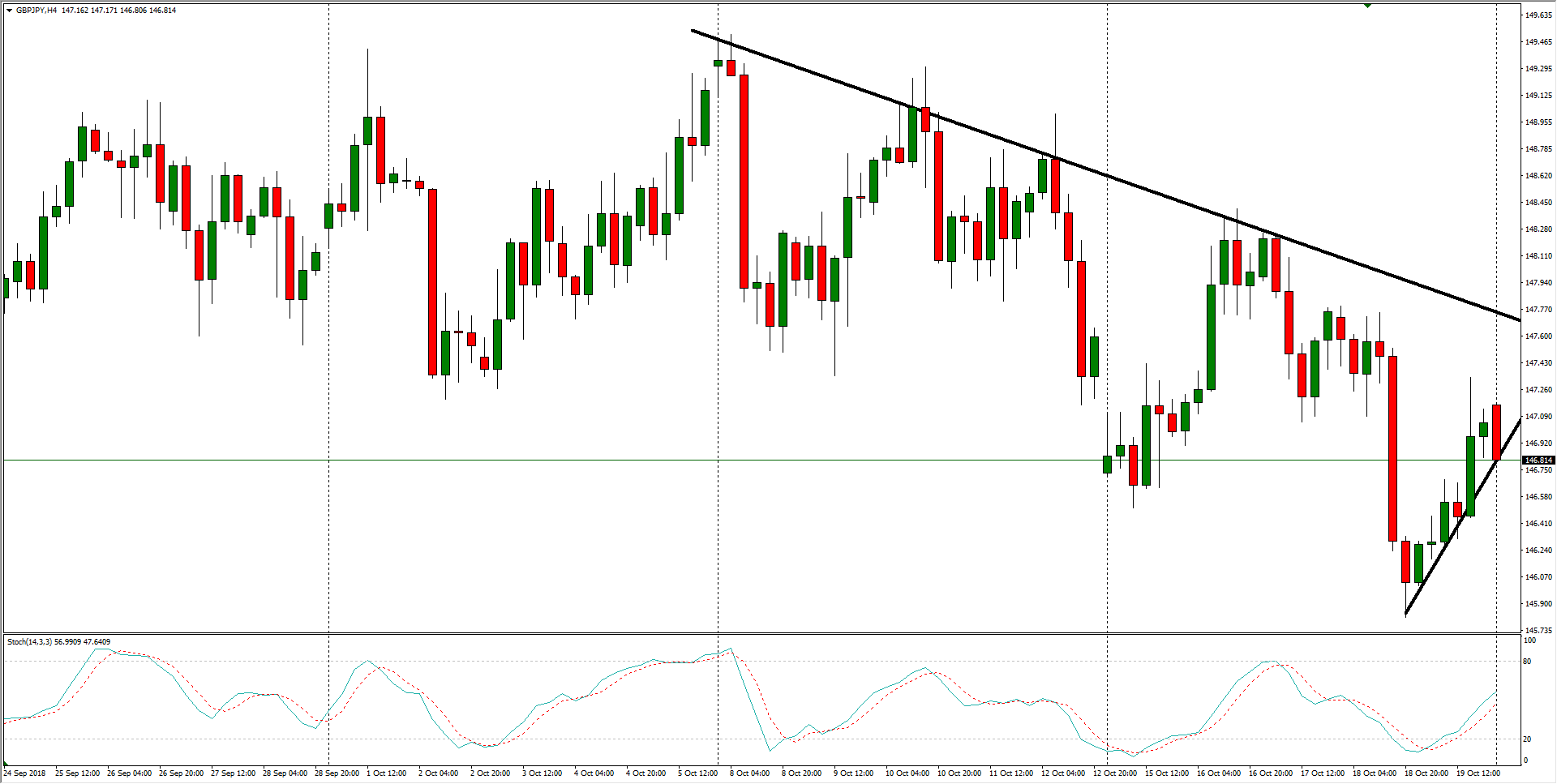

The past month has the GBP/JPY remaining in a bearish downside wave pattern, and the pair’s most recent leg could see the overall short trend begin to run out of steam from near 146.00.

GBP/JPY, H4

GBP/JPY

Overview:

Last Price: 146.18

Daily change: -7.0 pips

Daily change: -0.0479%

Daily Open: 146.25

Trends:

Daily SMA20: 147.94

Daily SMA50: 145.73

Daily SMA100: 145.89

Daily SMA200: 147.94

Levels:

Daily High: 147.59

Daily Low: 146.04

Weekly High: 148.42

Weekly Low: 145.81

Monthly High: 149.72

Monthly Low: 142.6

Daily Fibonacci 38.2%: 146.63

Daily Fibonacci 61.8%: 147

Daily Pivot Point S1: 145.67

Daily Pivot Point S2: 145.09

Daily Pivot Point S3: 144.13

Daily Pivot Point R1: 147.21

Daily Pivot Point R2: 148.17

Daily Pivot Point R3: 148.75