- DXY faded the initial optimism and is giving away part of Friday’s gains on the back of a better tone in the risk-associated space.

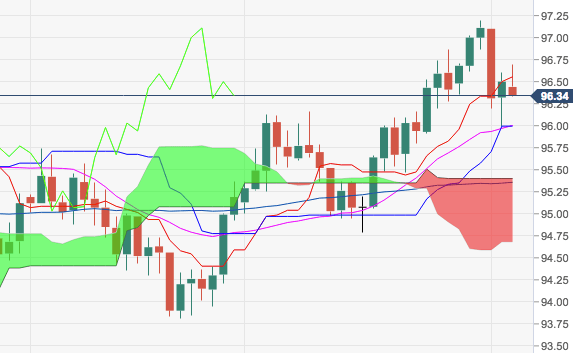

- The earlier bullish attempt run out of steam in the mid-96.00s, where aligns the 10-day SMA. Ideally, the index should retake this area and above to allow a potential new visit to YTD peaks beyond the 97.00 milestone.

- On the downside, strong contention emerges in the 96.00 neighbourhood, where converge recent lows and a Fibo retracement of the 2017-2018 drop.

DXY daily chart

Dollar Index Spot

Overview:

Last Price: 96.34

Daily change: -16 pips

Daily change: -0.166%

Daily Open: 96.5

Trends:

Daily SMA20: 95.99

Daily SMA50: 95.34

Daily SMA100: 95.18

Daily SMA200: 93.17

Levels:

Daily High: 96.6

Daily Low: 95.99

Weekly High: 97.2

Weekly Low: 95.99

Monthly High: 97.2

Monthly Low: 94.79

Daily Fibonacci 38.2%: 96.37

Daily Fibonacci 61.8%: 96.22

Daily Pivot Point S1: 96.13

Daily Pivot Point S2: 95.75

Daily Pivot Point S3: 95.52

Daily Pivot Point R1: 96.74

Daily Pivot Point R2: 96.97

Daily Pivot Point R3: 97.35