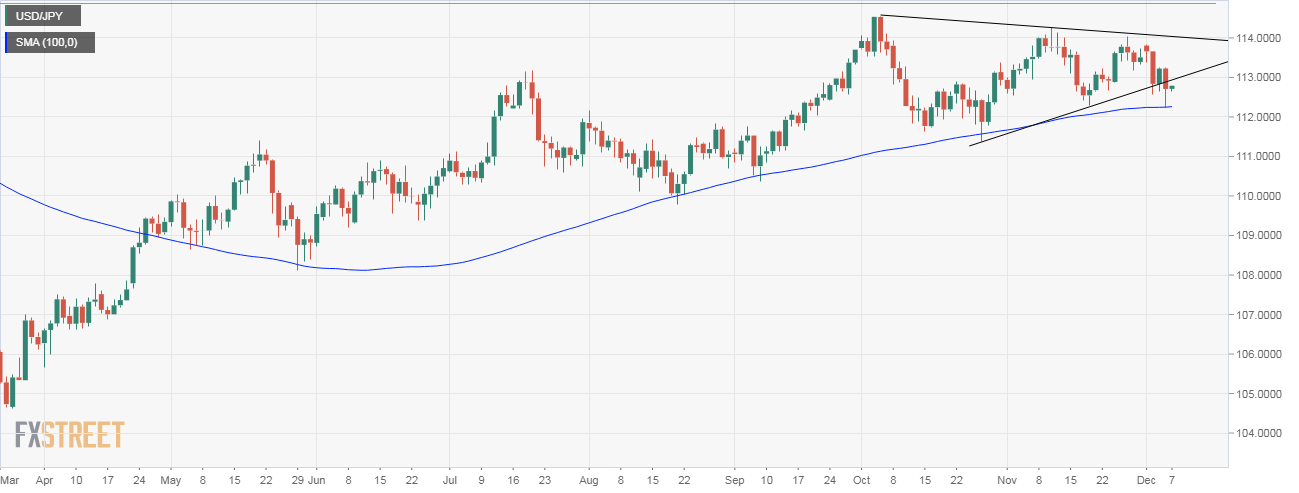

The USD/JPY is currently trading at 112.75 – up 0.10 percent on the day – having bounced off from the 100-day moving average (MA) support yesterday.

Daily chart

- As seen above, the 100-day MA reversed pullbacks on a closing basis in May, August, September, and October. So, the long-term average is the level to beat for the bears.

- A daily close below the 100-day MA, if and when confirmed, would imply an end of the rally from the March low of 104.63 and would open the doors for a deeper pullback to levels below 110.00.

The prospects of a convincing break below that long-term average look weak if we take into account the growing Fed-BOJ monetary policy divergence.

Indeed, BOJ governor Kuroda ruled out additional stimulus while speaking in parliament earlier today, but also said that it is too early to taper or unwind its massive monetary easing. Meanwhile, the Fed is set to hike rates in December and may deliver more hikes in 2019.

Trend: Bearish if closes below 100-day MA

USD/JPY

Overview:

Today Last Price: 112.76

Today Daily change: 5.0 pips

Today Daily change %: 0.0444%

Today Daily Open: 112.71

Trends:

Previous Daily SMA20: 113.29

Previous Daily SMA50: 113.08

Previous Daily SMA100: 112.25

Previous Daily SMA200: 110.55

Levels:

Previous Daily High: 113.24

Previous Daily Low: 112.23

Previous Weekly High: 114.04

Previous Weekly Low: 112.88

Previous Monthly High: 114.25

Previous Monthly Low: 112.3

Previous Daily Fibonacci 38.2%: 112.62

Previous Daily Fibonacci 61.8%: 112.86

Previous Daily Pivot Point S1: 112.21

Previous Daily Pivot Point S2: 111.72

Previous Daily Pivot Point S3: 111.2

Previous Daily Pivot Point R1: 113.22

Previous Daily Pivot Point R2: 113.74

Previous Daily Pivot Point R3: 114.24