- A weaker US dollar boosted the EUR/USD pair after the FOMC meeting.

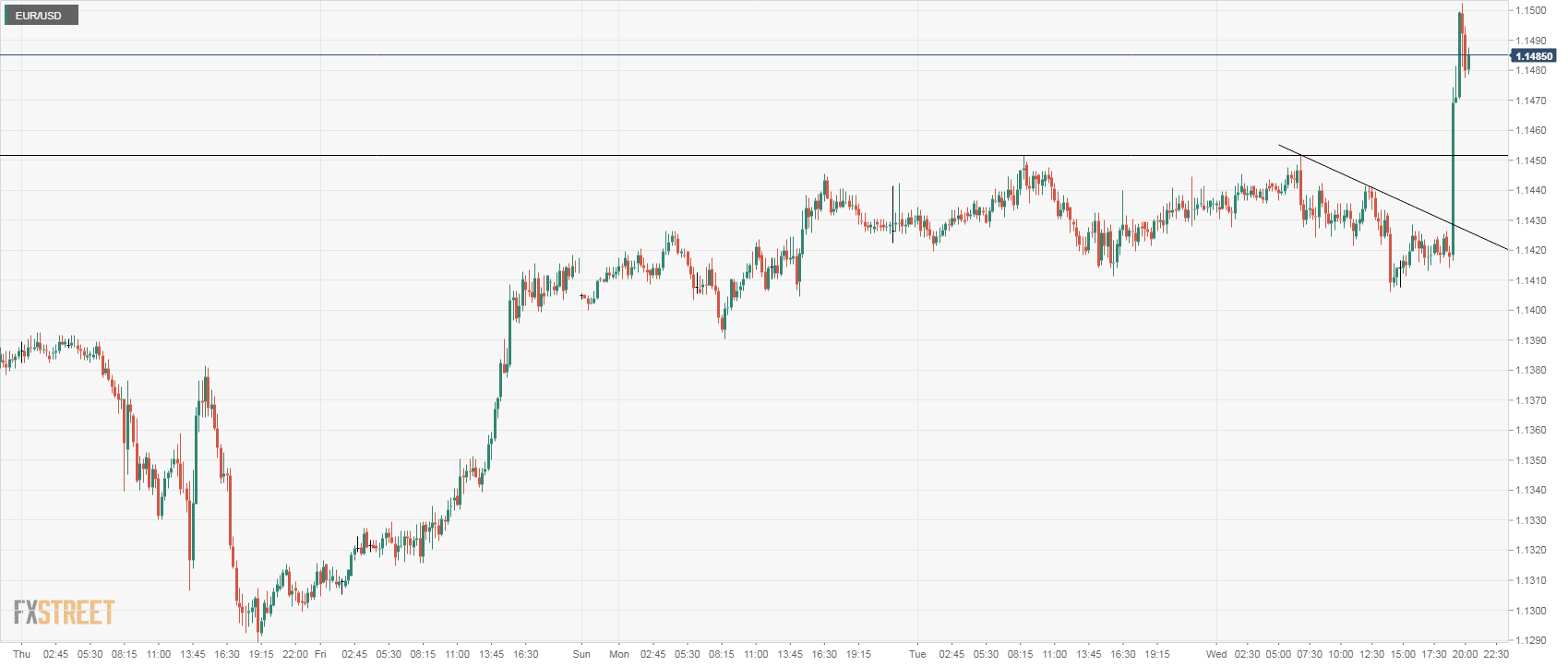

- The pair broke to the upside and reached at 1.1502 the highest level since January 11. Now the 1.1450 area is the immediate support. While holding above, more tests to the 1.1500 area seem likely.

EUR/USD 15-minute chart

- Today’s rally pushed the pair back above the 100-day moving average and so far the euro is holding firm above the key area of 1.1450. The rally was capped at 1.1500 that is being challenged. A break higher should lead to further gains and to a test of a downtrend line from September highs, currently at 1.1525. If it consolidates on top, 1.1560 looks like the next target.

EUR/USD Daily chart

EUR/USD

Overview:

Today Last Price: 1.1485

Today Daily change: 0.0052 pips

Today Daily change %: 0.45%

Today Daily Open: 1.1433

Trends:

Daily SMA20: 1.1415

Daily SMA50: 1.1391

Daily SMA100: 1.1448

Daily SMA200: 1.1571

Levels:

Previous Daily High: 1.1451

Previous Daily Low: 1.1411

Previous Weekly High: 1.1418

Previous Weekly Low: 1.1289

Previous Monthly High: 1.1486

Previous Monthly Low: 1.1269

Daily Fibonacci 38.2%: 1.1436

Daily Fibonacci 61.8%: 1.1427

Daily Pivot Point S1: 1.1412

Daily Pivot Point S2: 1.1392

Daily Pivot Point S3: 1.1372

Daily Pivot Point R1: 1.1453

Daily Pivot Point R2: 1.1472

Daily Pivot Point R3: 1.1493

-636844774753180328.png)