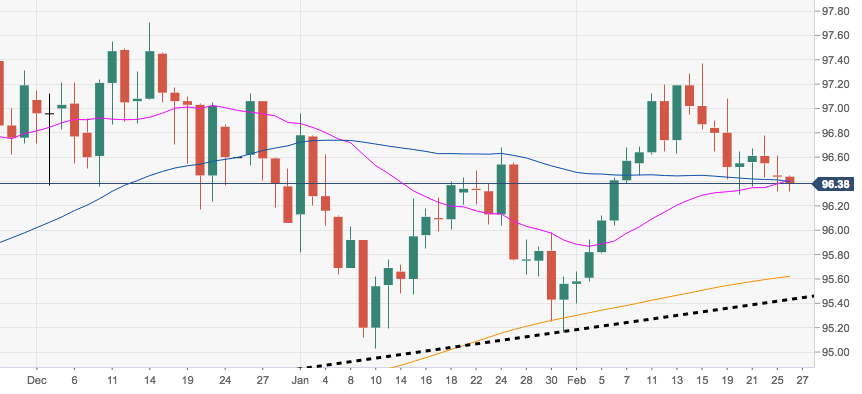

- The greenback keeps trading on the defensive and risks a deeper retracement to, initially, the 96.22 level, where lies a Fibo retracement of the September-December rally.

- A breakdown of this initial area of support could pave the way for a potential down move to the critical 200-day SMA, today at 95.62.

- In the meantime, the outlook on the index is expected to remain constructive while above the short-term support line, today at 95.43.

DXY daily chart

Dollar Index Spot

Overview:

Today Last Price: 96.4

Today Daily change: 13 pips

Today Daily change %: -0.04%

Today Daily Open: 96.44

Trends:

Daily SMA20: 96.41

Daily SMA50: 96.33

Daily SMA100: 96.43

Daily SMA200: 95.61

Levels:

Previous Daily High: 96.61

Previous Daily Low: 96.32

Previous Weekly High: 97.08

Previous Weekly Low: 96.29

Previous Monthly High: 96.96

Previous Monthly Low: 95.03

Daily Fibonacci 38.2%: 96.43

Daily Fibonacci 61.8%: 96.5

Daily Pivot Point S1: 96.3

Daily Pivot Point S2: 96.17

Daily Pivot Point S3: 96.01

Daily Pivot Point R1: 96.59

Daily Pivot Point R2: 96.75

Daily Pivot Point R3: 96.88