AUD/USD is on the bids near 0.7150 at the start of Good Friday trading holiday for the majority of the global markets except for China and Japan.

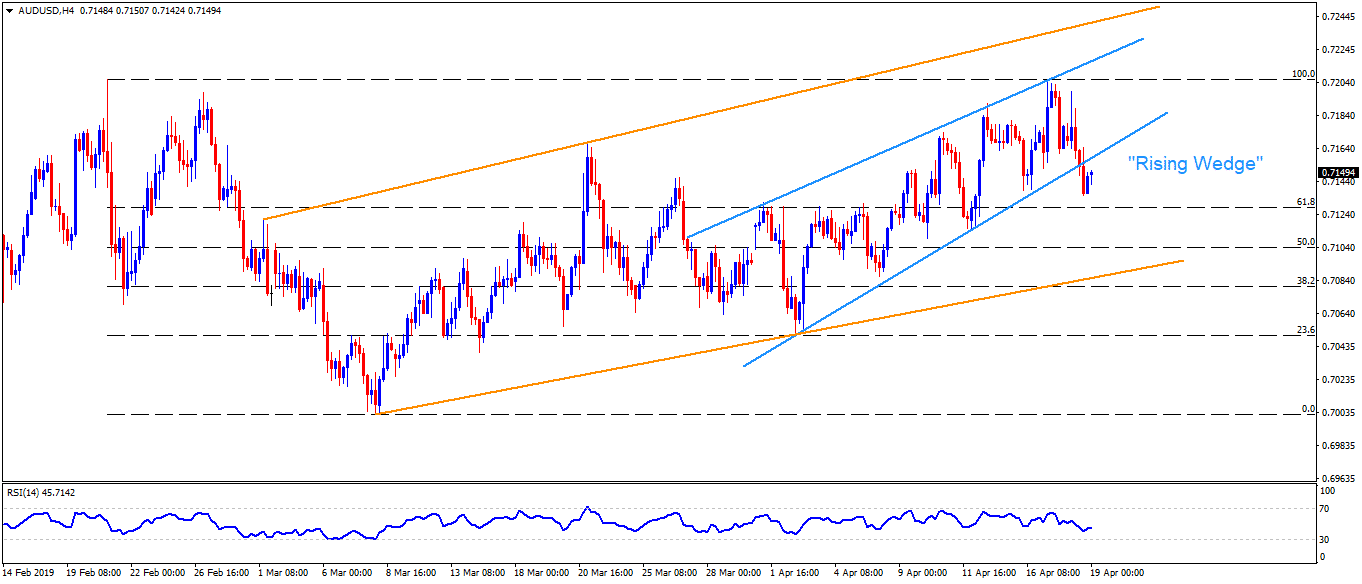

The Aussie pair confirmed the “rising wedge” bearish technical formation on Thursday when it slipped beneath the pattern support, at 0.7160 now.

With this, the quote is likely to extend its south-run towards 0.7070. Though, an ascending trend-line stretched since early March might offer strong intermediate support at 0.7085.

In addition to 0.7085, 61.8% Fibonacci retracement of February to March downturn near 0.7130 and 0.7110 can also entertain sellers.

Assuming the quote’s extended downside past 0.7070, 0.7040 and March month low near 0.7000 can come back on the chart.

Meanwhile, an upside clearance of 0.7160 support-turned-resistance opens the gate for the pair’s recovery toward 0.7180 and 0.7210 numbers to the north.

However, an upward sloping trend-line since March 27 at 0.7220 and another resistance-line joining highs since March 01 at 0.7240 can question buyers past-0.7210.

AUD/USD 4-Hour chart

Trend: Bearish