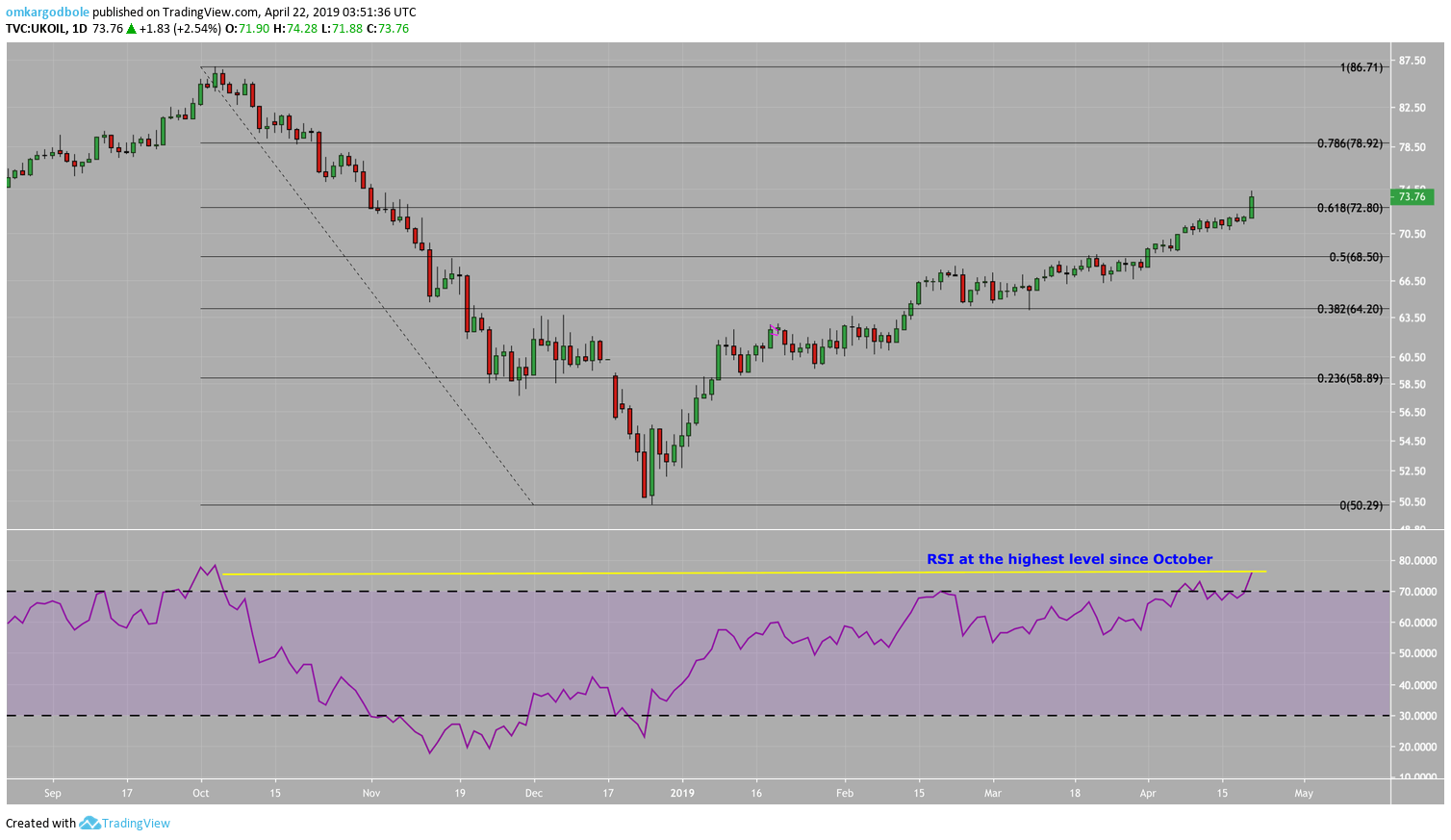

Brent oil has pulled back from the five-month high of $74.28 hit earlier today, but the price is still holding well above $72.80, which is the 61.8 percent Fibonacci retracement (golden ratio) of the drop from the October highs to December lows.

As of writing, Brent is changing hands at $73.78 per barrel, representing a 2.57 percent gain on the day, with the 14-day relative strength index (RSI) at 76.08 – the highest levels since October. Put simply, brent is most overbought in five months.

Overbought readings on the RSI do not imply bearish reversal but represent temporary bullish exhaustion, which usually yields a minor pullback or consolidation.

Any dips will likely be short-lived, as the US is reportedly planning to force the Iranian oil imports to zero.

Daily chart

Trend: Overbought