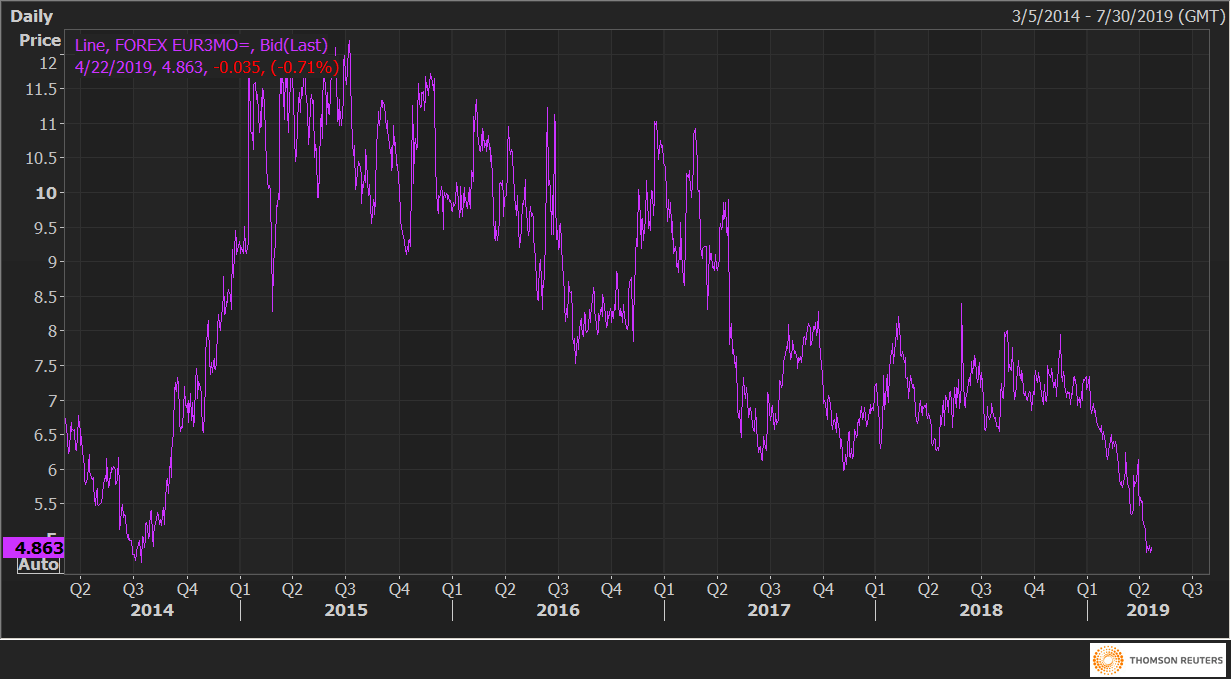

The FX markets and EUR/USD, in particular, could be in for a big move soon, as the three-month ATM (at-the-money) volatility on the common currency (EUR3MO) has dropped to the lowest level since June 2014.

The gauge currently stands at 4.86, having hit a low of 4.80 last week, a reading last seen nearly five years ago.

An extended period of low volatility often paves the way for a violent move on either side. It is worth noting that the EUR/USD has lacked a clear direction bias since late October. The weekly chart shows the pair has been restricted largely to 1.1550-1.1170 range for the sixth month straight.

A big move to the downside?

Notably, the big move could happen to the downside, as recent macro data releases have suggested the US economy fared well in the first three months of this year than previously thought. The Atlanta Fed’s GDPNow tracker, which began the year with a 0.3 percent first-quarter growth projection, is now forecasting a growth rate of 2.8 percent.

Supporting that bearish case is the historical data which shows the volatility gauge’s drop to lows near 4.80 in June 2014was followed by a nearly 90-degree drop from 1.37 to 1.04 in nine months to March 2015.

EUR3MO

Weekly chart

-636915051676454245.png)