- The cross moves above 10.6600, fresh 2019 highs.

- The Riksbank left the repo rate unchanged at -0.25%.

- A rate hike is on the cards by end 2019/early 2020.

The Swedish Krona is quickly depreciating vs. its European peer on Thursday and is now lifting EUR/SEK to fresh 2019 highs beyond 10.6600 the figure.

EUR/SEK higher on dovish Riksbank

SEK is sharply lower today, dropping to levels last seen in mid-August 2018 around 10.6600 vs. the single currency after the Riskbank left its interest rate unchanged at today’s meeting, broadly in line with market expectations.

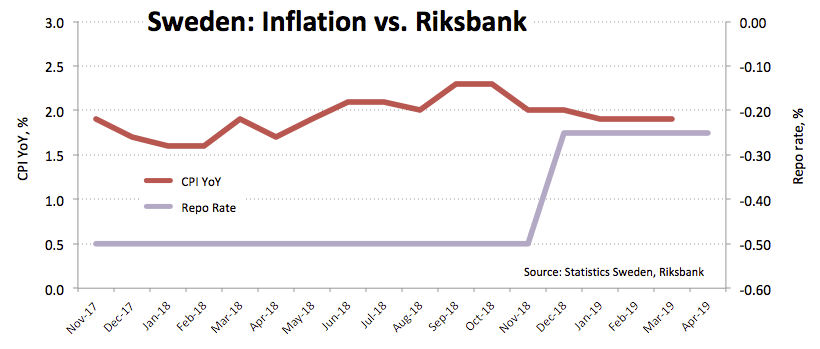

However, the message from the Scandinavian central bank fell on the dovish side after noting that inflationary pressures are running at a weaker pace than initially forecasted and that inflation in the next years is now seeing a tad lower than previous projections.

The bank also said that the key rate could stay in current levels for longer than expected, although it has reiterated that a rate raise could still come at some point by year-end or earlier next year followed by rate hikes at a slower pace than previously estimated.

What to look for around SEK

Sluggish inflation figures in the Nordic economy coupled with the absence of upside traction in wages have been undermining hopes of reaching the Riksbank’s target despite the sharp depreciation of the Krona in past months. The Riksbank still keeps a rate hike on the table by year-end or early 2020 in spite of increasing skepticism among investors, particularly against the backdrop of the ‘neutral for longer’ stance now expected from the ECB, in line with the majority of its G10 peers.

EUR/SEK levels to consider

As of writing the cross is up 1.17% at 10.6390 and faces the next hurdle at 10.6646 (2019 high Apr.25) seconded by 10.6929 (monthly high May 3 2018) and then 10.7290 (2018 high Aug.29). On the flip side, a break below 10.4860 (55-day SMA) would expose 10.3876 (200-day SMA) and finally 10.3769 (low Apr.1).