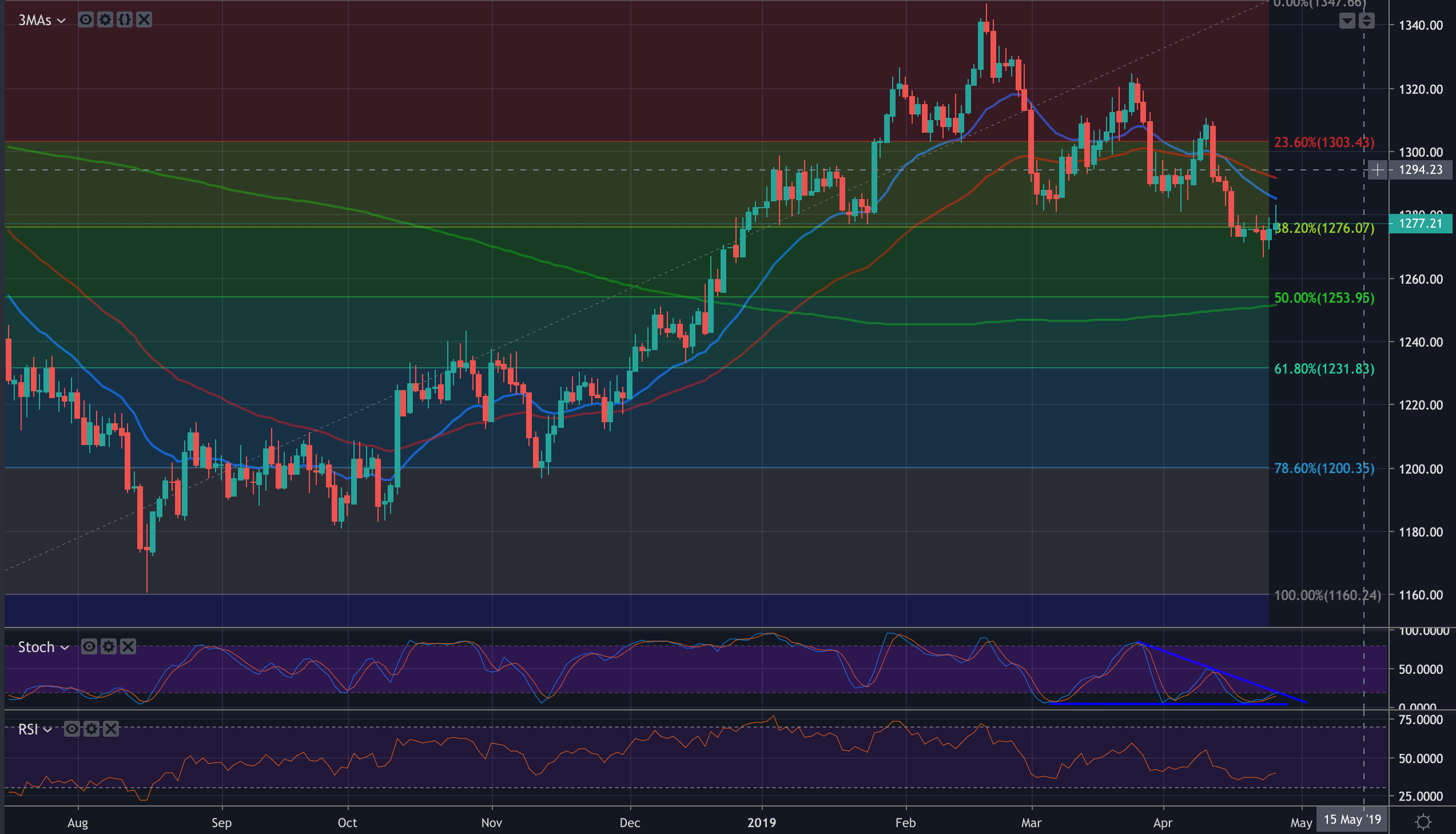

- The bullish divergence on the momentum indicators such as RSI and stochastics kicked in on Thursday (with some help in global data and soft equities playing their role as well).

- However, the gold has been capped just ahead of the 20-D EMA by a resilient greenback. A break of 1285 and or, at least, a hold above 1280 would be required to shake out some speculative shorts before bulls could target 1303 with a look in at 1308 (61.8% Fibo) and the trendline resistance.

- On a resumption of the downside, a close below the 38.2% Fibo and 1275 would open prospects back for the 200-D EMA and confluence area of the 50% retracement target of 1250/1253 respectively.