Gold is taking the rounds near $1276 while heading into the European open on Thursday. The yellow metal has been on recovery from Tuesday when it plummeted to the 2019 lows.

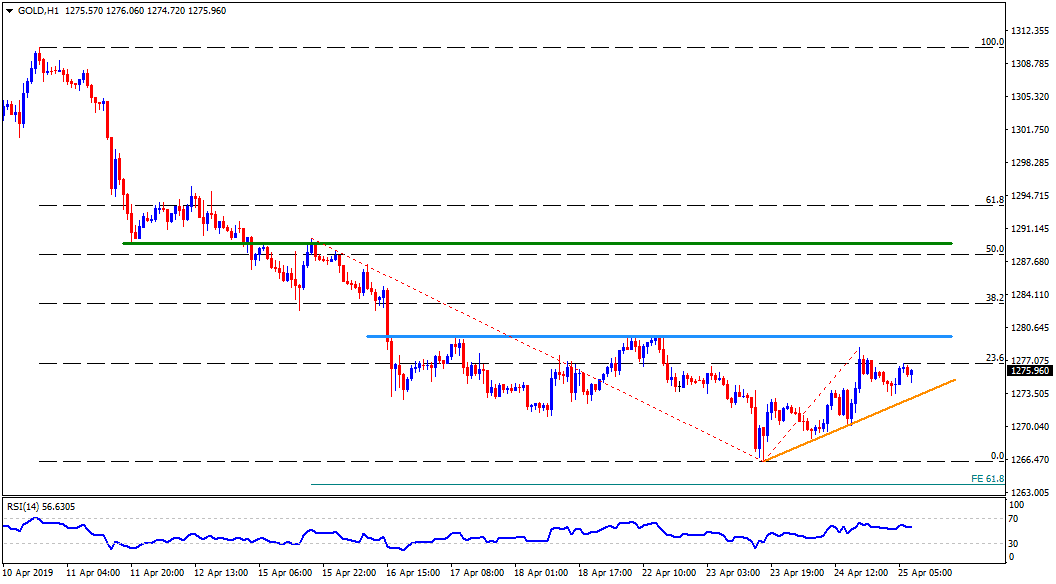

On the hourly chart, an upward sloping support-line joining recent lows, at $1273, seems immediate important support, a break of which can recall $1271 and $1268.50 on the chart.

However, latest lows near $1266, eight-month-long ascending support-line on the daily chart near $1265 and 61.8% Fibonacci expansion (FE) of its April 15-24 moves at $1263.50 can entertain sellers afterward.

Alternatively, a horizontal-line connecting high since April 16 at $1280 becomes nearby important resistance, a break of which should escalate the recovery to $1283.50 and another horizontal upside barrier near $1285.50/60.

Should there be increased buying pressure around $1285.60, $1290.00 and $1296.00 a could become Bulls’ favorite during the additional rise.

Gold hourly chart

Trend: Pullback expected