- The index gives away part of Wednesday’s gains, returns to 97.60.

- Fed held rates steady, noted economy remains strong.

- Yields of the US 10-year note bounce off 2.46%.

The greenback, in terms of the US Dollar Index (DXY), is struggling for direction around the 97.60 area as markets continue to digest the recent FOMC meeting.

US Dollar Index now focused on Payrolls

Following the volatile session on Wednesday, the index is now looking to consolidate in the 97.60 region as European traders are slowly returning to their desks.

The greenback ended yesterday’s session on a positive note after Chief J.Powell said the current slow pace of inflation is ‘transitory’, slashing at the same time prospects of rate cuts and disappointing USD-bears.

Powell also reiterated the ‘patient’ stance of the Federal Reserve, also noting there is no need for it to be changed. Chief Powell stressed the solid health of the US economy and noted the Fed sees inflation returning to the 2% target over time.

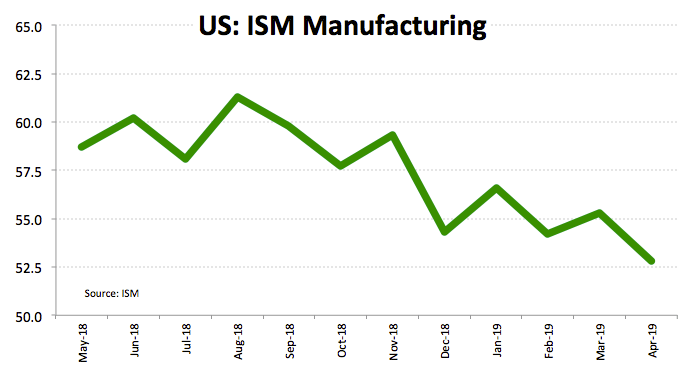

In the data space, and apart from the FOMC event, the ISM manufacturing dropped to 52.8 during April, missing expectations, while the ADP report came in stronger than forecasted at 275K during the same period.

Later today, Challenger Job Cuts is due seconded by Initial Claims and Factory Orders.

What to look for around USD

The greenback recovered some of its shine in the wake of the FOMC event after Chief Powell disappointed dovish expectations and left no room for speculations of rate cuts in the next months. Concerns over the lack of traction in inflation now appear mitigated after Powell suggested the recent drop in inflation should be deemed as temporary. All in all, the constructive bias in the buck is posed to remain unchanged on the back of overseas weakness, its safe haven appeal, favourable yield spreads vs. its peers and the status of global reserve currency. Despite further progress in the US-China trade talks carries the potential to somewhat undermine the positive outlook on USD in the near term, rising scepticism among investors should mitigate bouts of optimism surrounding this event.

US Dollar Index relevant levels

At the moment, the pair is retreating 0.02% at 97.60 and a breach of 97.15 (low May 1) would aim for 96.98 (55-day SMA) and finally 96.75 (low Apr.12). On the other hand, the next up barrier emerges at 98.32 (2019 high Apr.25) seconded by 99.89 (high May 11 2017) and then 100.51 (78.6% Fibo of the 2017-2018 drop).