- Multiple HMAs and 23.3% Fibo restrict immediate decline.

- Australia’s retail sales, current account and RBA details to grab major market attention.

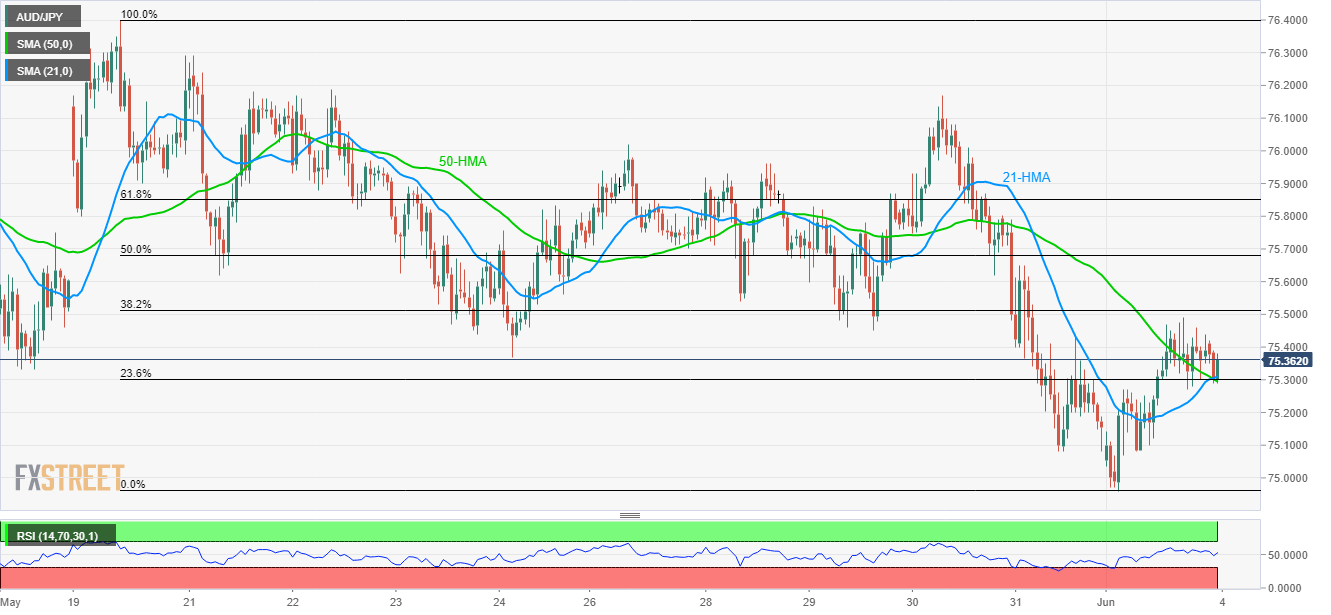

Even after taking a U-turn from 75.50, AUD/JPY still holds immediate important support confluence as it takes the rounds near 75.35 during the early Asian session on Tuesday.

In addition to technical triggers, investors will also be interested in watching Australia’s first quarter (Q1) 2019 current account, April month retail sales, and monetary policy meeting decision from the Reserve Bank of Australia (RBA).

While the current account balance could go up to -2.5 billion from 7.2 billion and the seasonally adjusted retail sales might soften to +0.2% from +0.3% earlier, RBA is likely to steal the show with its much anticipated 0.25% rate cut.

On the technical front, 21 and 50-hour moving averages (HMAs) join 23.6% Fibonacci retracement of the quote’s downturn since May 20 to highlight 75.30 as strong downside support.

Should prices slip under 75.30, 75.10 and 75.00 could quickly appear on the chart whereas July 2016 low near 74.50 may gain bears’ attention then after.

Meanwhile, 75.50 and 50% Fibonacci retracement near 75.70 can entertain short-term buyers ahead of challenging them with 76.20 upside barrier.

In a case where bulls manage to dominate past-76.20, 76.40 and 77.00 may become their next targets.

AUD/JPY hourly chart

Trend: Pullback expected