- The rise of the Japanese Yen (JPY), due to its safe-haven status, drags the quote to weekly lows.

- 200-HMA and short-term ascending trend-line appear on bears’ radar.

- Oversold RSI questions further decline.

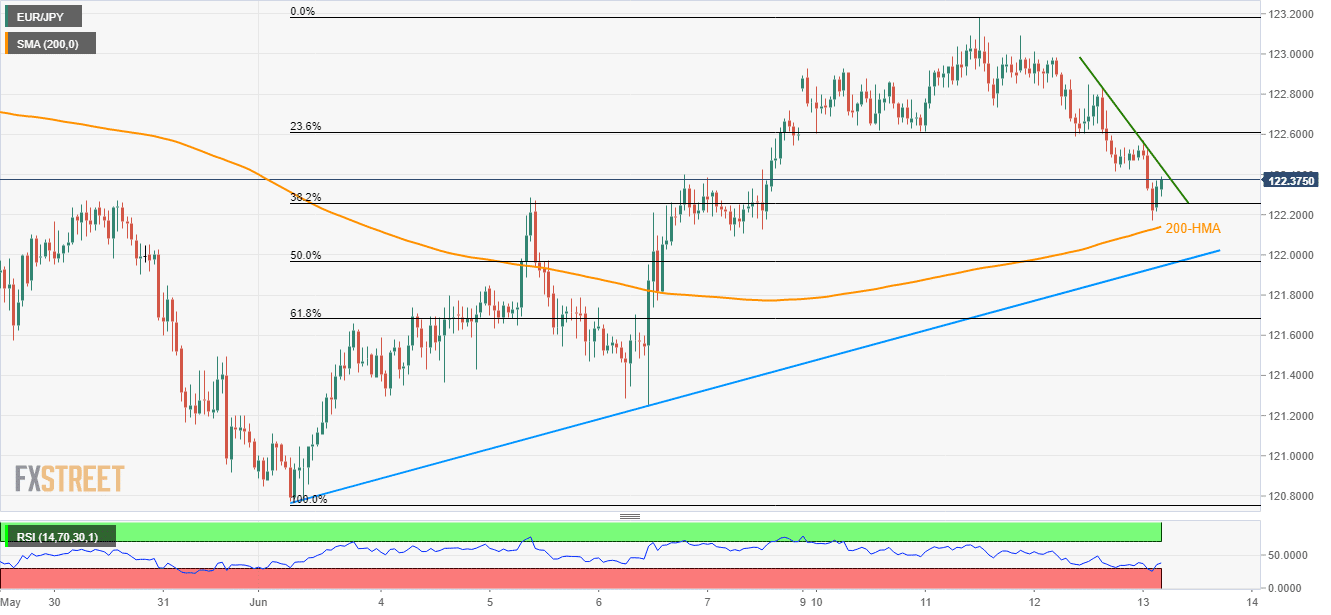

With the risk-off sentiment directing EUR/JPY downwards, sellers may aim for 200-HMA and short-term support-line during further declines. The quote presently trades around 122.37 ahead of the European open on Thursday.

Other than 200-hour moving average (HMA) level of 122.14 and a trend-line stretched since June 03 at 121.94, 61.8% Fibonacci retracement of its latest upside near 121.60 can also entertain the bears.

However, oversold levels of 14-bar relative strength index (RSI) can question the pair’s further declines, if not then last Thursday’s low near 121.25 and the 121.00 round-figure come back on the chart.

On the flipside, 122.45 acts as immediate resistance, a break of which can trigger the pair’s fresh advances to 23.6% Fibonacci retracement level of 122.65 and then to 123.00.

During the quote’s additional rise over 123.00, the current month high near 123.18 and 50-day simple moving average (SMA) on the daily chart at 123.80 can please buyers.

EUR/JPY hourly chart

Trend: Pullback expected