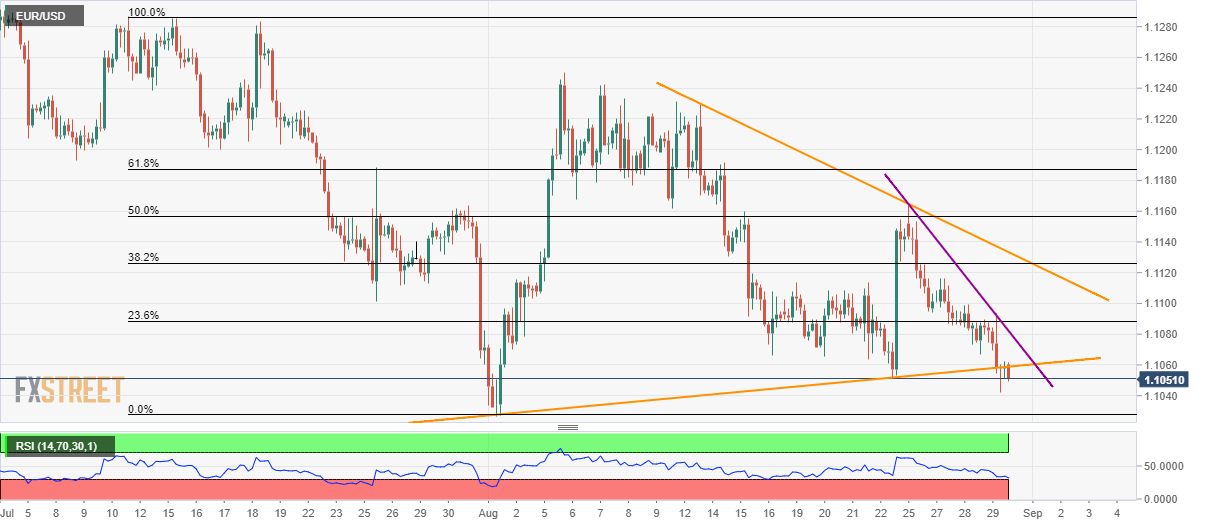

- EUR/USD slips beneath a monthly triangle.

- Oversold RSI can trigger pullback to four-day-old resistance-line.

Failure to extend bounce beyond monthly’s triangle support presently drags EUR/USD to 1.1051 during the Asian session on Friday.

The quote now aims to revisit August 01 low of 1.1027 whereas 1.1000 round-figure could question further declines.

If traders concentrate on oversold conditions of 14-bar relative strength index (RSI), another pullback is due to challenge immediate resistance-line near 1.1082, a break of which can escalate the recovery to 38.2% Fibonacci retracement of July-August declines, at 1.1126.

However, the triangle pattern’s resistance at 1.1135 can limit the EUR/USD pair’s additional upside, if not then 1.1165 and 1.1200 could lure buyers.

EUR/USD 4-hour chart

Trend: pullback expected