- EUR/USD weakened on Monday as European PMIs disappointed.

- Europen Central Bank’s (ECB) President, Mario Draghi, reiterates that the ECB is ready to act.

- The level to beat for bears is the 1.0965 support level.

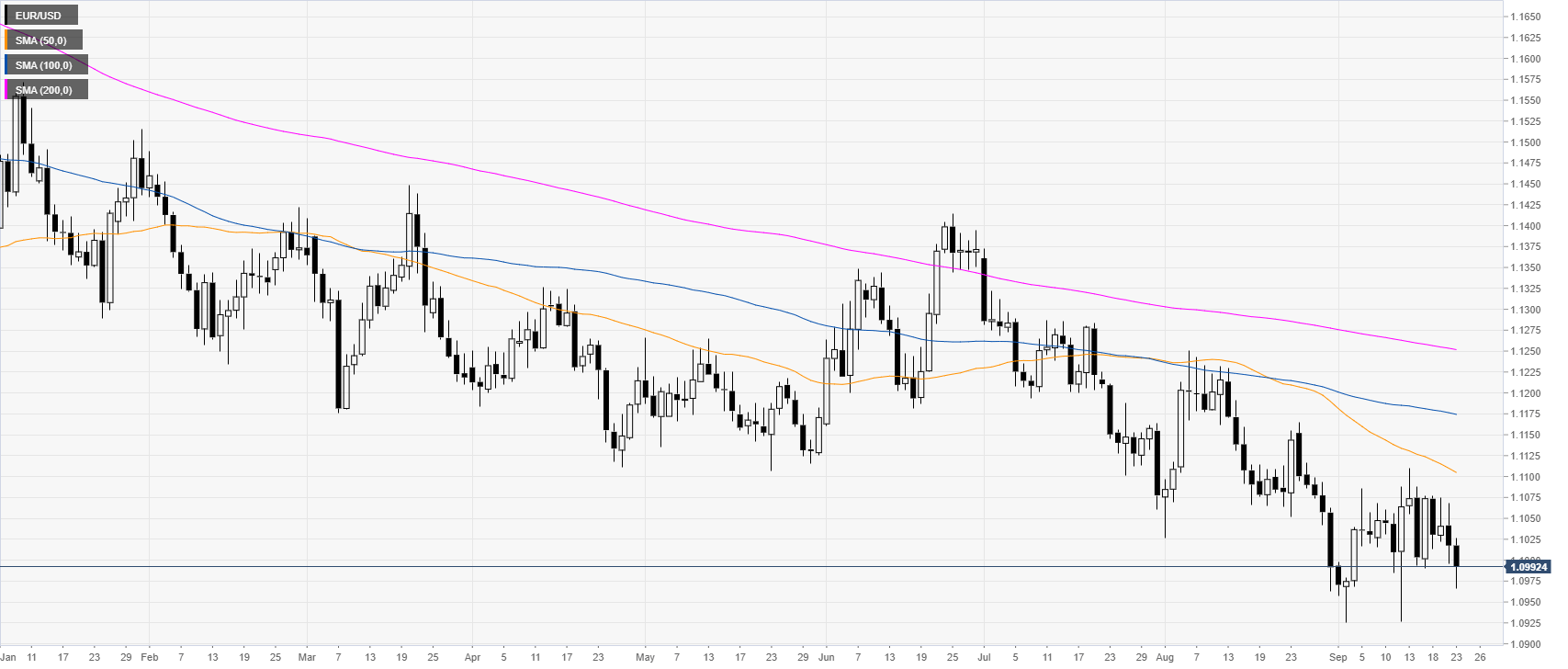

EUR/USD daily chart

On the daily chart, the common currency is trading in a downtrend below the main daily simple moving averages (DSMAs). In the European session, the Markit PMI in the Eurozone, Germany and France came in below expectations while in the New York session, ECB’s President, Mario Draghi, reiterated that the ECB is ready to act.

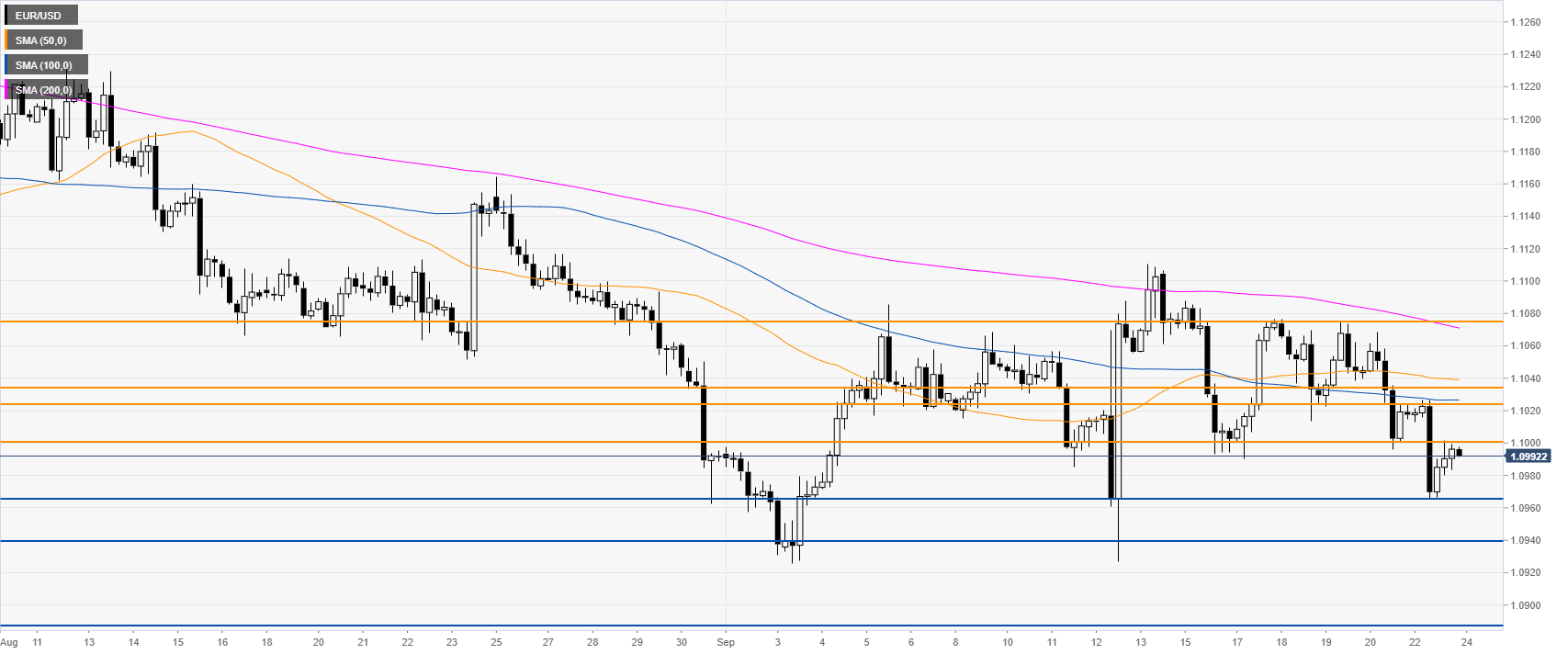

EUR/USD four-hour chart

EUR/USD is trading below its main SMAs, suggesting a bearish momentum in the medium term. The Fiber is retracing while staying below the 1.1000 figure. A break below the 1.0965 support (current Monday low) can expose 1.0940 (near the 2019 low) and 1.0887 price level, according to the Technical Confluences Indicator.

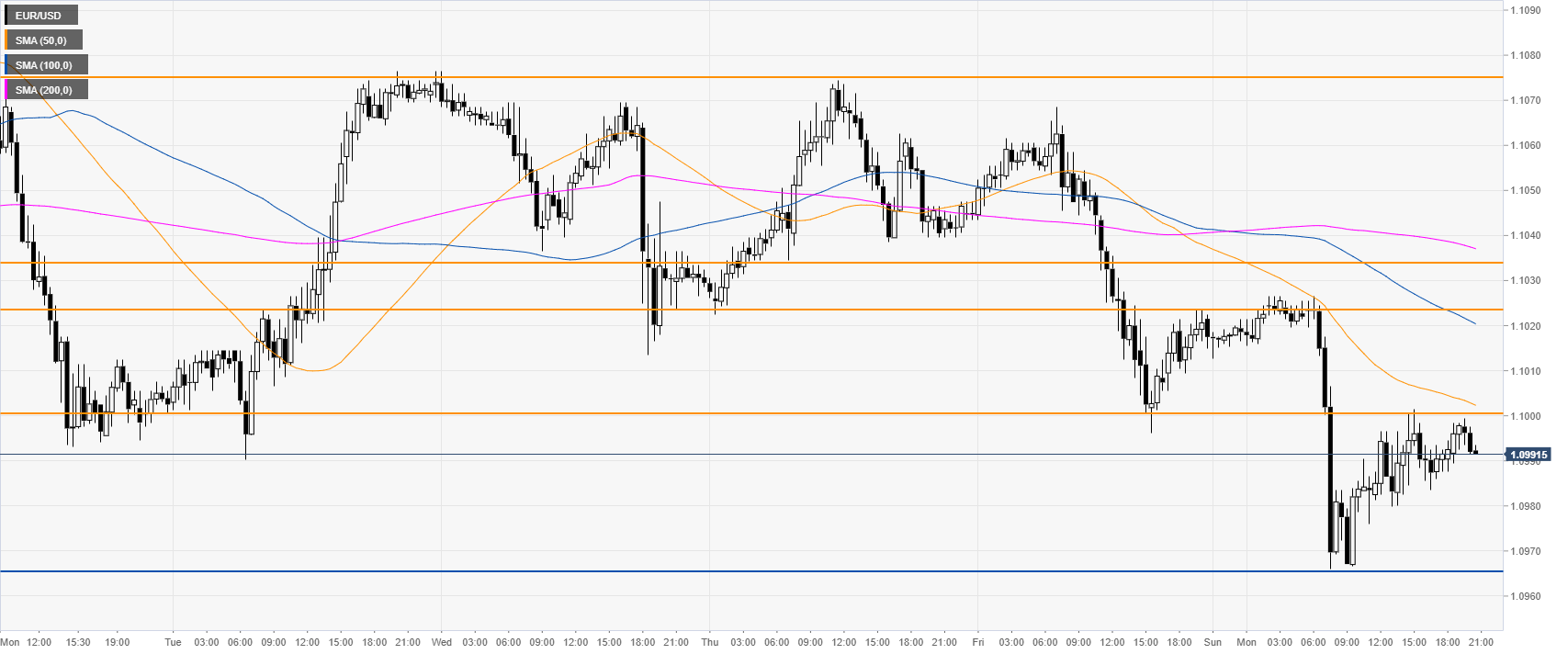

EUR/USD 30-minute chart

EUR/USD is rolling into the Asian session below the 1.1000 figure and its main SMAs, suggesting bearish momentum in the near term. The 1.1000 figure is currently capping any upside attempt. However, a break of 1.1000 can expose the 1.1023/35 resistance zone and the 1.1075 price level, according to the Technical Confluences Indicator.

Additional key levels